Most of today's machine tool companies are from Germany. As the world's most developed machine tool technology country, the German government has always attached importance to the important strategic position of the machine tool industry, and both basic scientific research and applied technology research.

The machinery of the World-Germany

The scope of the machinery industry includes the machinery industry in a broad sense and machinery industry in a narrow sense. The machinery industry in a broad sense includes general machinery, electronic motors, vehicles, precision appliances, etc. The machinery industry in the narrow sense usually refers to the machinery and equipment industry. In Germany, the English for machinery and equipment industry is Mechanical Engineering, and in Japan, the English for the general machinery industry is General Machinery.

The representatives of the world's best mechanical powers are Germany, the United States, and Japan. The population of Germany is 82.79 million, and the national income is US$47,450/person-year. The United States has a population of 327.16 million people, and its national income is US$62,850/person-year. Japan has a population of 126.23 million, and its national income is US$41,340 per person-year.

Germany is the world's machinery leader. Germany's population is 65% of Japan, and its exports of machinery and equipment are 1.77 times that of Japan. Germany's population is only 25% of the United States, and exports are 1.52 times that of the United States. The German Machinery Association VDMA announced that its exports in 2018 were 177.8 billion euros, of which Europe accounted for 57%, Asia accounted for 24%, North America accounted for about 12%, and other markets accounted for about 7%.

According to the information released by the German VDMA Machinery Association, in 2017, Germany accounted for 15.9% of global machinery and equipment trade, China accounted for 13.2%, the United States accounted for 10.0%, Japan accounted for 9.6%, Italy accounted for 7.3%, and the top five combined accounted for about 6 Into trade volume.

The German VDMA Machinery Association estimates that the global turnover of the machinery and equipment industry in 2018 was 2.600 billion euros. The top five producing countries are Mainland China, the United States, Germany, and Japan, which together can account for more than 70% of global revenue. The top ten can account for more than 80% of global revenue. Germany's machinery and equipment industry revenue reached 297 billion euros in 2018, accounting for 11.4% of the global machinery and equipment industry.

Industry 4.0 German machine tools focus on smart factories

The proportion of general machinery industry in manufacturing

The general machinery industry is the most important in advanced countries. According to data from advanced countries such as Germany and Japan, the machinery industry in a broad sense accounts for about half of the overall manufacturing industry.

According to data from the German manufacturing industry, in 2018, the machinery and equipment industry revenue was 232 billion euros, the electronic and electrical industry was 193 billion euros, the transportation tool industry was 300 billion euros, and the manufacturing revenue was 1.5010 billion euros. The machinery industry in Germany accounted for the manufacturing industry of 48%.

Representative indicators of the German machinery and equipment industry

The machinery industry is the most important in advanced countries. According to data from advanced countries such as Germany, Japan, and the United States, the machinery industry accounts for about half of the overall manufacturing industry.

The machinery and equipment industry must support the country’s overall manufacturing industry, and more importantly, the defense industry. The country’s production business relies on the machinery and equipment industry to enhance its competitiveness. An independent defense industry needs the support of excellent machinery and equipment.

The characteristics of the machinery and equipment industry are a large investment, slow recovery, high-tech talents, etc. The machinery and equipment industry is a real capital-intensive, technology-intensive, and talent-intensive industry, and the machinery and equipment industry has many small and medium-sized enterprises, and Germany has many The hidden champion of the industry.

Germany's machinery and equipment industry are the industry with the highest productivity for engineering and technical personnel. It ranks among the top in the world in German machinery and equipment companies, employment, corporate revenue, personnel productivity, production, and exports. Germany is also the world's number one machinery and equipment industry.

In 2018, the German machinery and equipment industry had 6,523 entrepreneurs (3,200 VDMA members, accounting for about half), total industrial revenue of 232.5 billion euros, employment of 1.05 million employees, and employee productivity of 218,200 euros/person-year. Production value is 224.3 billion euros, total exports are 177.8 billion euros, imports are 75 billion euros, domestic sales are 46.5 billion euros, and the domestic market is 121.5 billion euros.

Representative products of the German machinery and equipment industry

The machinery and equipment industry are the most important industry in advanced countries. According to data from advanced countries such as Germany, Japan, and the United States, the machinery and equipment industry is the foundation that supports the country's overall manufacturing industry. The machinery and equipment industry must support the country’s overall manufacturing industry. The country’s production business depends on the machinery and equipment industry to enhance its competitiveness. The machinery and equipment industry in Germany can be broadly classified into more than 30 products, with more than 100 products in the middle and thousands of sub-categories products, etc.

Representative industries of the German machinery and equipment industry include power transmission engineering, material handling technology, air transportation technology, machine tools, food packaging machinery, agricultural machinery, valves, and pipe fittings, construction machinery and building materials machinery, fluid power equipment, etc. The industry can account for about half of exports. Also, plastic and rubber machinery, textile machinery, pumps, woodworking machinery, engine systems, mining equipment, whole plant equipment, robots and automation, compression and vacuum systems, precision tool tools, inspection and testing technology, printing, and papermaking technology, etc., have representatives’ sex.

Others such as semiconductor and panel equipment, heat transfer process technology, elevators and escalators, motor automation technology, power systems, foundry machinery, garment and leather technology, metal smelting production equipment, industrial furnaces, welding technology, cleaning systems, disaster relief equipment, safety, and insurance equipment, etc.

Representative export products of German machinery and equipment industry

The machinery and equipment industry are the most important industry in advanced countries. According to data from advanced countries such as Germany, Japan, and the United States, the machinery and equipment industry is the foundation that supports the country's overall manufacturing industry. Germany is also the world's largest exporter of machinery and equipment products.

Germany’s representative product projects in the machinery and equipment industry had an export value of 155.8 billion euros in 2016, such as air transportation systems and technology exports of 10.3 billion-yuan, accounting for 6.6% of total exports. The power transmission project was 13.7 billion euros, accounting for 8.8% of total exports. Valves and pipe fittings exported 7.85 billion euros, accounting for 5.0%. Construction machinery and building materials machinery 7.84 billion euros, accounting for 5.0%. Exports of material handling products and technologies amounted to 11.2 billion Euros, accounting for 7.2%. The export value of agricultural machinery was 8.01 billion euros, accounting for 5.1%. The export value of food and packaging machinery was 8.29 billion euros, accounting for 5.3%. Machine tool exports amounted to 9.18 billion euros, accounting for 5.9%. These eight industries can account for about half of exports.

Printing and paper technology were 4.28 billion euros, fluid power equipment was 5.92 billion euros, pump exports were 5.01 billion euros, woodworking machinery was 2.04 billion euros, compressors and vacuum systems were 4.93 billion euros, and plastic rubber machinery was 4.92 billion euros. Euros, inspection and testing technology 3.57 billion euros, power system 5.40 billion euros, precision tool tools 5.55 billion euros, textile machinery export value 2.30 billion euros, and whole plant equipment export value 5.46 billion euros are representative.

Others such as mining equipment, engine systems, semiconductor and panel equipment, robotics and automation, metal smelting production equipment, heat transfer process technology, elevators and escalators, motor automation technology, foundry machinery, garment and leather technology, industrial furnaces, welding Technology, cleaning systems, disaster relief equipment, safety and insurance equipment, etc.

According to the statistics of the German Machinery Association VDMA, the representative countries and regions of machinery and equipment export in 2018, such as the United States, ranked first, with an export value of 19.2 billion euros, accounting for 10.8%. China's second-place exports 19.1 billion euros, accounting for 10.7%. Third France exports 11.6 billion euros, accounting for 6.5%. I followed the order of 8.3 billion euros for Italy, 7.7 billion euros for the United Kingdom, 7.4 billion euros for the Netherlands, 7.2 billion euros for Poland, 7 billion euros for Austria, 5.5 billion euros for the Czech Republic, 5.5 billion euros for Russia, etc.

If analyzed in terms of export regions, Europe’s largest export value is 101.6 billion euros, accounting for 57.1%. Asia's export value was 41.9 billion euros, accounting for 23.6%. The third North American export value is 20.9 billion euros, accounting for 11.8%.

Germany's machinery and equipment industry's top representative industries in the world

The German machinery and equipment industry mainly support the entire country’s manufacturing industry. The country’s production business depends on the machinery and equipment industry to enhance its competitiveness. The most important thing is to export to the global market. The German machinery and equipment industry can be classified into more than 30 products, half of which Left and right exports rank first in the world, and some products rank second in the world.

Germany’s machinery and equipment industry are representative of the world’s number one product item in the trade. For example, inspection and testing technology account for 31.9% of global trade, cleaning systems for 29.1%, woodworking machinery for 27.4%, printing and papermaking technology for 24.3%, and fluid power for 23.9%, plastic and rubber machinery 22.7%, power transmission engineering 21.3%, machine tools 20.8%, food and packaging machinery 20.8%, industrial furnaces 19.4%, agricultural machinery 19.1%, and material handling technology 18.7%, Compressors, and vacuum systems accounted for 16.3%, whole plant equipment accounted for 16.1%, pumps accounted for 16.1%, etc.

Also, the second-ranked products in the world, such as textile machinery accounted for 18.5%, precision tool tools accounted for 16.1%, valves and pipe fittings accounted for 13.8%, power systems accounted for 12.8%, welding technology accounted for 12.5%, air transportation technology accounted for 11.1%, etc. All six industries have occupied important positions in the world.

Export projects and markets of German machinery and equipment industry in 2018

Germany is the world leader in machinery and equipment. The population of Germany is 65% of Japan, and the export of machinery and equipment is 1.77 times that of Japan. The population of Germany is 25% of the population of the United States, and exports are 1.52 times that of the United States. According to German customs statistics, the export value of machinery and equipment in 2018 was US$254.9 billion, an increase of 9.9% over the previous year.

Germany’s representative product projects in the machinery and equipment industry have an export value of US$254.9 billion in 2018. The representative product ranks first with an export value of US$42.2 billion in engines and other components, accounting for 16.6% of total exports. The second export value of fluid machinery was 22.4 billion US dollars, accounting for 8.8% of the total export. The third chemical machinery export value was 20.3 billion US dollars, accounting for 8.0%. Yu Yixu is $19 billion in mechanical components, accounting for 7.5%.

At present, the castings, sheet metal, controllers, and other parts required for machine tools can all be provided locally.

Special function machinery is USD 18 billion, accounting for 7.1%. The export value of valves and alternative parts was 14.3 billion US dollars, accounting for 5.6%. The export volume of paper and printing machinery was USD 13.4 billion, accounting for 5.3%. The export value of transport machinery was US$11.7 billion, accounting for 4.6%. Machine tool exports amounted to 10.4 billion US dollars, accounting for 4.1%. These nine products can account for about 70% of exports.

Besides, the export value of plastic and rubber machinery was US$6.40 billion, the export value of textile machinery was US$5.59 billion, construction machinery was US$5.08 billion, air-conditioning and refrigeration equipment were US$4.52 billion, machine tool components were US$4.08 billion, semiconductor and panel equipment were US$2.28 billion, and woodworking machinery was exported. It is also represented with a value of US$2.06 billion.

Others such as mining equipment, robots and automation, metal smelting production equipment, heat transfer process technology, elevators and escalators, motor automation technology, manufacturing machinery, garment and leather technology, industrial furnaces, welding technology, cleaning systems, disaster relief equipment, Safety, and insurance equipment, etc.

In the 2018 export market of German machinery and equipment, the United States ranked first with an export value of 28 billion US dollars, accounting for 11.0% of total exports, an increase of 12% over the previous year. Mainland China ranked second with an export value of US$24.2 billion, accounting for 9.5% of exports, an increase of 14% over the previous year. The third French export value is 16.7 billion US dollars, accounting for 6.6%, an increase of 8.6% over the previous year. Yu Yisequ’s exports to the United Kingdom are USD 13.6 billion, accounting for 5.4%. Exports to Italy were $11.7 billion, accounting for 4.6%. Exports to the Netherlands are 11.2 billion US dollars, accounting for 4.4%. Exports to Austria were 10.9 billion US dollars, Poland 10.7 billion US dollars, Spain 8.64 billion US dollars, Czech Republic 8.25 billion US dollars, Russia 7.66 billion US dollars, Switzerland 6.71 billion US dollars, etc. The top 12 export markets accounted for more than 60% of Germany exports.

Germany machinery and equipment industry is the strongest in the world

The machinery and equipment industry are the most important industry in advanced countries. According to data from advanced countries such as Germany, Japan, and the United States, the machinery and equipment industry is the foundation that supports the country's overall manufacturing industry.

The export value of Germany machinery and equipment in 2018 was 254.9 billion U.S. dollars, an increase of 9.9% over the previous year. German machinery and equipment exports to Europe accounted for 57%, Asia accounted for 24%, North America accounted for about 12%, and other markets accounted for about 7%.

Germany’s exports of semiconductors, panel equipment, and electronic machinery in 2018 were 2.28 billion U.S. dollars. If compared with the United States, Japan, the Netherlands, etc., it is in a backward situation. The main reason is that Germany itself lacks the electronics and semiconductor industries, so there is no industry to experiment. The research and development of this type of mechanical equipment cannot be continued.

Germany is the strongest producer and exporter of the global machinery and equipment industry, especially in the high-end machinery and equipment industry. Germany's technology and engineering capabilities, technical personnel, system integration, etc., are in a leading position in the world. However, in emerging high-tech industries such as electronics, optoelectronics, semiconductors, and other industrial machinery and equipment, they are clearly behind the United States and Japan. The main analysis is that Germany and Europe lack such manufacturing companies, and the emerging high-tech industries, mainly in Asia and North America, and this type of industrial equipment is more suitable for research and development in North America and Northeast Asia.

Nowdays Germany machine tool market

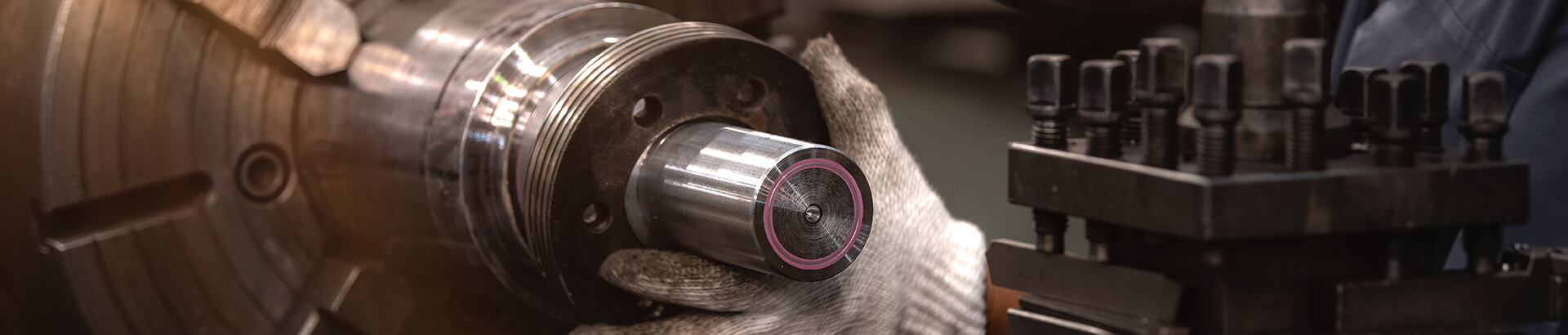

Germany machine tools focus on the development of smart factories and Industry 4.0. under the wave of Industry 4.0, Germany has developed internet of things applications and gradually implemented it in the machine tool industry, accelerating the integration process of smart factories, committed to 5G applications, metal 3D printing, and digitization production is moving towards a smart factory in all directions, truly implementing human-machine collaboration.

According to the Communiqué of the German Machine Tool Manufacturers Association (VDW), Taiwan's exports to Germany ranked tenth in the first half of 2019 (60 million euros), an increase of 4% over the same period in 2018. Among them, machine tools accounted for 90% of the 54 million euros, with the remainder being parts and components, and the two grew by 4% and 5% respectively compared with the previous year. On the whole, the German machine tool industry is not affected by the "US-China trade war" because it mainly sells to the domestic market in China, or is not affected due to the special products and high technical content. However, it is necessary to observe that China's domestic demand is indirectly affected by the trade war. The slowdown in market growth leads to subsequent problems.

The COVID-19 has affected local economic activities in Germany and people's consumption and purchasing power. Although Germany and even the entire European countries have not stopped manufacturing production activities, most machine tool manufacturers have experienced the impact of the US-China trade war and the suspension of work in China due to the epidemic. After the shock, the stability of the external demand market cannot be guaranteed. At present, the domestic demand market that depends on 2019 will be worsened by the stagnation of the auto industry and the epidemic that has just begun to spread. 2020 will be a major test for the Germany machine tool industry. Germany machine tools increase profits through the transformation of intelligent manufacturing and other related services, actively enter different end application markets, and diversify risks by expanding some overseas markets with greater growth potential to overcome difficulties.

.jpg)

.jpg)

點-m-90454917_m.jpg)