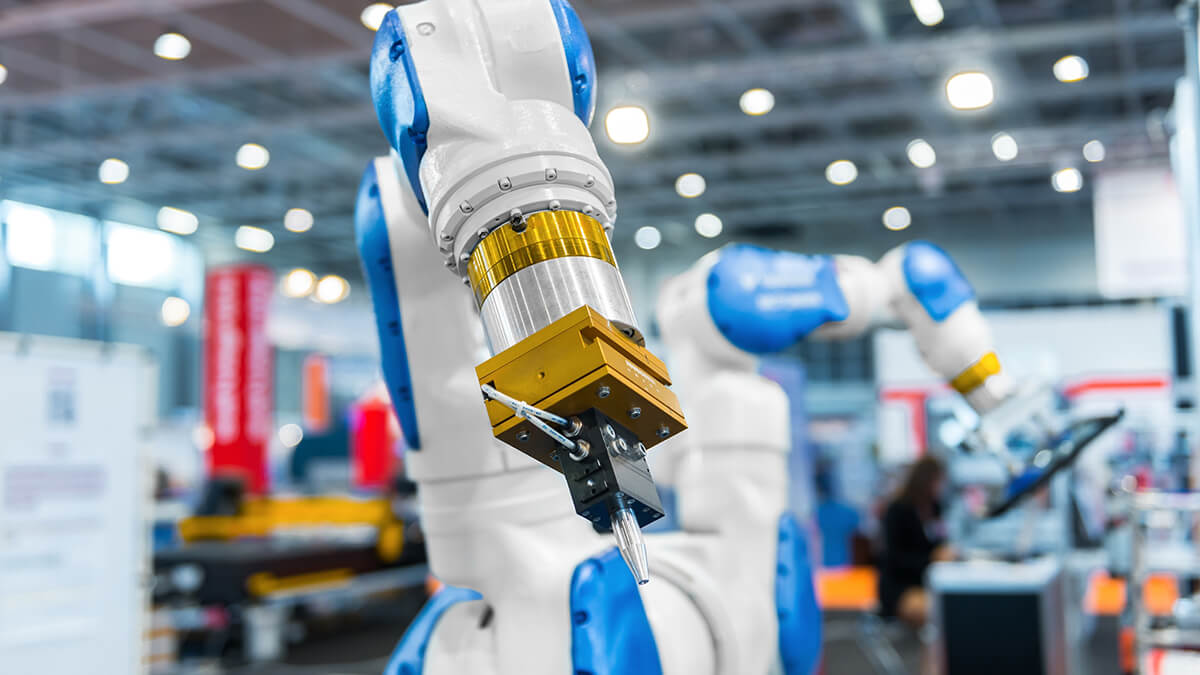

Why Do You Need A Collaborative Robot? What Are the Advantages of Collaboration?

Industrial robots can more quickly and handle large-scale mass production work. So far, nearly half of the industrial robots in the world are used by automobile factories. Let's understand the advantages and disadvantages and applications of industrial robots.

Published: May 21, 2020

Why do you need a collaborative robot?

If any new products are launched, if it is not that the existing products are not done well in some places, it is because the customers have new demands.

What are the advantages of collaboration?

The same is true of the rise of collaborative robots. Summarize the following three points:

- The purchase price of industrial robots is not high, but the cost of "import" is high, in other words, collaborative robots are not expensive

The robots used in industry have a selling price ranging from 400,000 to 1.8 million depending on the load capacity. In 10 years, it is not expensive in terms of general industrial equipment. Relatively speaking, collaborative robots are more expensive, and industrial robots are not expensive.

But the place where traditional industrial robots are expensive is the "import" (Deployment)-the installation is deployed online (the robot is installed on the production line and can be operated normally), for three reasons (the industrial robot has three highs):

- High learning curve - Industrial robots are not easy to use. Only trained professional robot engineers can use the robot to complete the setting, configuration, programming, and maintenance tasks. Common engineers rarely have such capabilities.

- High service charges - Only the in-plant robot engineers are not enough, and a system integrator (SI) who specializes in equipment can guarantee the smooth operation of the production line. Assuming that the purchase cost of one industrial robot is 1 million, and the installation, setting, and configuration of SI, then 1 million or 2 million (1: 2 or 1: 3)

- The high cost of land occupation - Current industrial robots are mainly responsible for repetitive work in the factory (fixed-point positioning) so that the robot can accurately take or perform an operation to the same place every time. For modern and complex assembly line operations, the operating environment that needs to be “defined” for the production management of each robot on the entire production line requires a lot of time and resources—occupying a large area of valuable factory space (especially in East Asia. Thick country) and the introduction for several months.

- Traditional industrial robots have basically killed the secret technique of Taiwan's small and medium-sized enterprises-quickly grab orders

The big outbreak of Ford's sales is because of the revolutionary mass production in the 1930s. It is the most popular production method in the 20th century. It is mainly based on the decomposition of the production process, assembly lines, standardized parts, mass production, and mechanical repetitive labor. feature. It is generally called Industry 2.0.

The target customers of traditional industrial robots are enterprises that can be mass-produced, which explains that nearly half of the industrial robots in the world have been used by automobile factories so far.

The reason why large enterprises such as automobile factories are relatively insensitive to the high deployment costs of industrial robots is that after the product configuration is finalized, the production line can not be changed for a long enough time (a new car is released from the market to exit the market) It usually takes 3 to 6 years (German cars are 6 to 8 years because the foundation is hard enough)). During this period, even if there are changes, only minor changes or skinning of the exterior and interior are carried out. These changes generally do not affect the work of the robot (body welding, painting, main parts handling)), the robot basically does not need to be renewed Programming or redeployment can maximize the use of robots' standardization and high efficiency, and maximize the value of execution investment.

Relatively speaking, the 3C electronic product industry is more difficult to apply. The replacement rate of electronic products in the 3C industry is high. A new model is used every year. It is relatively unloadable for industrial robots to use this cycle frequency, and more cost is required to update or adjust.

In addition, small and medium-sized enterprises (SMEs) are currently major customers of emerging markets for industrial robots. At present, traditional industrial robots cannot meet the needs of SME because the products produced by small and medium-sized enterprises are generally customized, small batches, and urgent orders. 3. The short production cycle is a feature. There is not much capital (more importantly, there is no US time) to carry out the large-scale transformation of the production line, and the product ROI is more cautious.

Therefore, 3C manufacturing and small and medium-sized enterprises will require automated production lines with low total cost (Total Cost), rapid deployment / re-deployment capabilities, and simple on-site use by general engineers. These are difficult to achieve with traditional robots.

In addition, if more industrial robots are used, in most cases, the original production line needs to be revised, or even re-headed and re-erected, which not only requires huge investment but also may involve production suspension and transformation. It has long been robbed by other foundries, which is also the main reason why many Taiwanese factories have been slow to get robots.

In addition to capital investment, the 3C industry is often more concerned about timeliness. The common robot automation transformation schemes take 1 month to several months, but the products of the 3C industry cannot wait, and the speed of R & D of 3C products is also eliminated. From product design to production and shipment, we are seeking fast, there is no time to wait for the adjustment of industrial robots, etc. so that competitors have already shipped. In this case, the EMS foundry is still a winner. R & D for continuous overtime for one week, special training for the devil in the production line for 3 days, and immediate post, what robot!? But with the rapid increase of wages in China and ASEAN, the more people are willing to engage in manufacturing the less it comes, the simpler is that there are fewer and fewer people willing to stay in the factory, and installing an industrial robot cannot quickly grab orders.

Therefore, in accordance with the production characteristics of industrial robots, in addition to the 3C electronics industry, industrial robots are suitable for traditional manufacturing that can be mass-produced.

- Manufacturing labor has been exhausted, Taiwanese businessmen have nowhere to move, and production lines have to use some robots to work with fewer and fewer workers

Industrial robots have always been a model for high-speed automation equipment, but for historical and technical reasons, the safety of working with people is not the focus of the original development of robots (it can also be said that the robots were originally intended to replace 3D work and are dirty ( Dirty), tired (Difficult), dangerous (Dangerous)), so in most factories for safety reasons, it is generally necessary to use fences to isolate robots and personnel. Fortunately, for most of the work previously done by robots, no human involvement is required, and the robot can be completed independently.

However, with the rise in labor costs in China and the Association of Southeast Asian Nations, many other industries that have not used robots before or rarely have begun to seek robotic automation solutions, such as the mentioned 3C industry, SMEs, and medicine, food, logistics, and other industries. Or the CNC workshop where the space is generally urgent, the plastic shooting factory, etc.

The characteristics of these emerging industries are many types of products, generally small size, and high flexibility/flexibility requirements for operators. It is difficult for existing robots to provide satisfactory performance solutions under the control of cost and time. What should we do?

Humans are responsible for the senses (Sense), which is responsible for the production steps with relatively high requirements on vision, touch, and flexibility, and the robot is responsible for repetitive work using its fast, accurate, and characteristic.

For example, assembling a mobile phone/computer, the collaborative robot is responsible for putting the main parts and screws in the right place (Pick & Place), and the person is responsible for the cable installation, buckling, and screw locking. For example, when assembling a keyboard, the keys can be put in place by a person, and the robot can work with the buckle.

If humans and machines need to cooperate, it is too inconvenient to have a fence in between. Humans and robots must interact, and they must first pass through safety doors (opening and closing doors also use electricity and time). The overall efficiency is not as good as separate. Use people to get high. At this time, some additional technology is needed to ensure that the robot and humans can safely work in the same area, without the need for obstacles such as fences to be blocked in the middle, that is, the robot is required to have safe cooperation and the on-site engineers do not understand the program Language also responds quickly to temporary situations.

A human-robot collaborative robot is a new type of robot that can work side by side directly with humans without the use of safety fences for isolation. Human-robot collaborative robots are expected to fill the gap between fully manual assembly production lines and fully automated production lines. In the past, it was often said that robots replaced human labor, but now robots are more regarded as auxiliary tools. The strict boundaries between unchanging automation and manual labor are gradually being eliminated. High-efficiency sensors, intelligent control technology, and the most advanced software technology are integrated on the robot, ensuring safe cooperation between the human and the robot without a protective fence, and can be flexibly applied regardless of location and task. Through this scheme, employees can use the required number of robots in different production locations and for different purposes according to the required number of pieces.

Published by May 21, 2020

Source :solomon

.jpg)