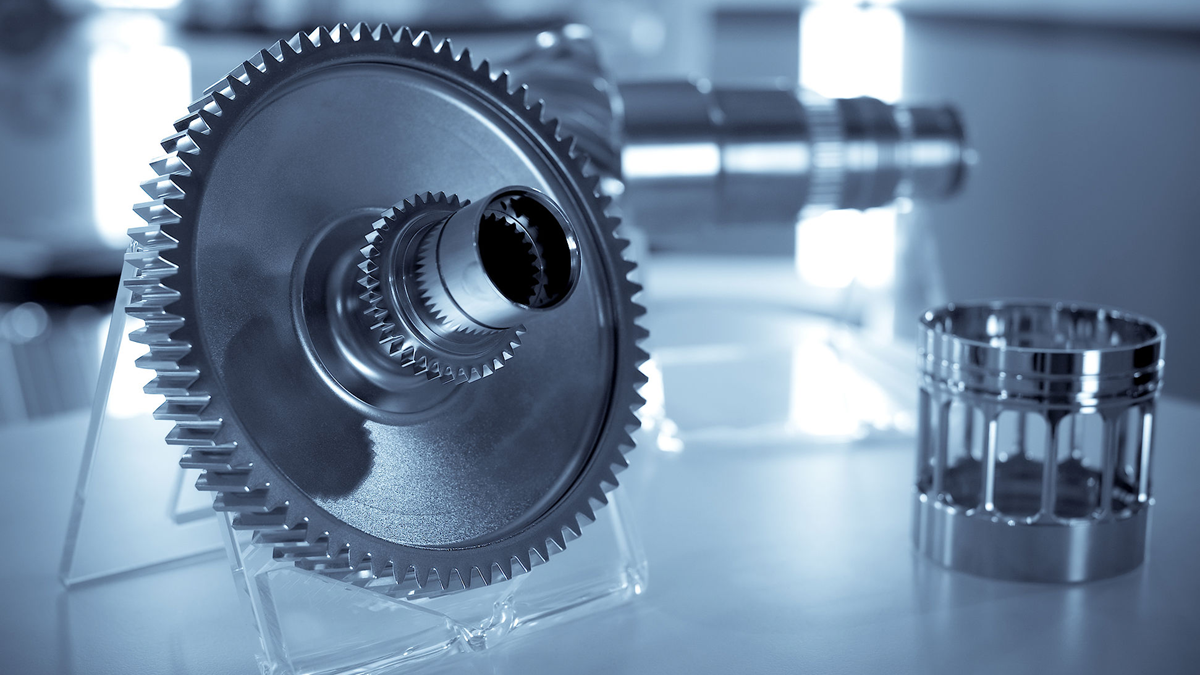

In an era where the long-standing "efficiency-first" mindset in global manufacturing is gradually reaching its end, supply chain resilience has become an essential condition for the new normal. The COVID-19 pandemic and geopolitical turbulence have highlighted the risks of lean supply chains, which struggle to recover quickly when disrupted. In response, major enterprises are shifting towards nearshoring, supply diversification, and early-warning-based adjustment strategies. Against this backdrop, "seemingly inconspicuous" small and medium-sized components, such as bearing sleeves, are making a comeback. Their functions in stabilizing mechanical operations and extending service life are proving to be key supports in healing the fragile structures of supply chains.

Driven by intelligence and high-growth markets

Supply chain restructuring is akin to a silent revolution: companies are no longer pursuing extreme cost-cutting or compressing inventory to minimal lead times. Instead, they are seeking the right balance between efficiency and redundancy. The rise of smart manufacturing technologies has become a key driver of both supply chain resilience and efficiency.

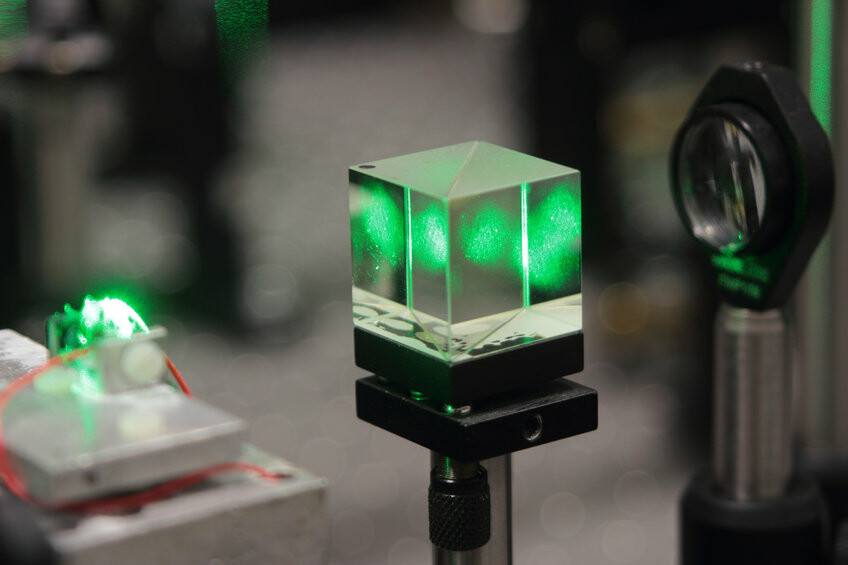

Through AI, IoT, digital twins, and big data simulations, enterprises can gain timely insights into risks, forecast demand, and restore operations, enhancing their ability to respond to potential supply disruptions.

Meanwhile, the overall bearing market continues to show robust growth. According to recent data, the global bearing market was valued at approximately USD 132.55 billion in 2024 and is projected to surge to around USD 329.40 billion by 2034, with a compound annual growth rate (CAGR) exceeding 9.5% during this period.

This growth encompasses key small and medium-sized components like bearing sleeves, which are experiencing remarkable growth potential due to applications in sectors such as automotive (especially electric vehicles), wind energy, industrial automation, and aerospace.

Chin Sing Precision's Market Positioning

As a professional manufacturer of bearing sleeves and precision components, Chin Sing Precision's core competitiveness lies in stable quality, reliable delivery, and material diversity. In the pursuit of supply chain resilience and localization, providing rapid response and stable supply as a small-scale supplier naturally makes it an important partner for brand engineering procurement.

Furthermore, if Chin Sing Precision further enhances its smart manufacturing capabilities, such as implementing AIoT-based quality monitoring and predictive maintenance systems, it will significantly improve process transparency and risk control, thereby increasing customer trust and reliance on its supply reliability. In this era of de-globalization and supply chain diversification, Chin Sing's geographical advantages and OEM/ODM flexibility position it as a crucial alternative and backup choice for cross-regional clients.

Strategic Recommendations and Future Outlook

To further strengthen this positioning, Chin Sing Precision should prioritize advancing smart manufacturing upgrades, establishing supply chain visualization frameworks, and AI forecasting capabilities to enhance production flexibility and risk response capabilities. Simultaneously, it is recommended that the company deepen cooperation in high-growth industries such as electric vehicles, wind energy, and high-end manufacturing to further expand its share in core markets.

In terms of brand image building, adopting sustainable materials, promoting green manufacturing processes, and fulfilling environmental and social responsibilities will help attract international clients with ESG requirements, enhancing influence and sustainable competitiveness.

Conclusion: The Significant Value of Small Components

As the global supply chain transitions from a "lowest cost" approach to a new normal characterized by "resilience and intelligence," companies like Chin Sing Precision, which focus on small and medium-sized components and possess stable quality and manufacturing flexibility, have the potential to become core pillars of the supply chain. It is recommended that the company adopt a three-pronged strategy of intelligent upgrading, green value addition, and market focus, allowing "small components" to play a "big future."