"Efficiency" is the most important key in the pursuit of success in the manufacturing process and the entire industry.

With the continuous development of some smart technologies that can promote efficiency, in the future, more enterprise entities will see smart technologies adopted, or at least carefully consider whether to accept and use. Automation is mainly used to supplement manpower shortage, not to replace manpower.

According to Manufacturing.net, automation, metrics-driven software packages, and other smart technology solutions have the dual advantages of improving quality control and reducing worker fatigue. Smart factories adopting smart technology will show four major trends.

-

Networked devices make the workplace safer

The Internet of Things (IoT) has great potential in the industry. For example, Wi-Fi sensors installed in factories can help inventory management by providing information on loss prevention strategies. Some employees have worn the Internet of Things (IoT) devices to ensure safety in hazardous work environments.

For example, the steelmaker North Star BlueScope Steel worked with IBM to explore an IoT device that can measure risk. This wearable device can be embedded in a helmet or wristband worn by employees, and the safety procedures are not followed, or employees may be involved. In the event of harm to health and safety, data will be automatically transmitted to the manager for information.

The “Liberty Mutual Workplace Safety Index” published in 2016 pointed out that work-related accidents have cost US companies nearly $62 billion a year. Factory managers investing in IoT equipment to prevent accidents are pursuing feasible measures to increase tolerance and reduce risk. If these measures work well, IoT technology can also be effectively used by other industries.

-

Predictive maintenance measures

An unexpected failure accident can cause a large amount of loss in an efficient factory. Even if it is delayed by a few minutes, it may also lose tens of thousands of dollars. Today, with multinational companies setting up factories around the world, this kind of accident damage situation has become more and more Complicated.

Many multinational companies have invested in predictive maintenance technology to reduce unexpected accidents that will hinder production levels. Although applications will vary according to the needs of different customers, typical predictive maintenance measures usually involve the use of components that are prone to damage Sensor; In addition, the analysis software package can provide real-time statistics of operation managers and performance and potential problems.

Belgian manufacturer of stacker cranes and aerial vehicle (AWP) operators TVH believes that problems occurring on the factory site may reduce goodwill and increase costs, and began to use IoT sensors to predict possible consequences before problems occur; in addition to detection In addition to the problem, the nearest mechanic is also located and the best path is drawn, so that employees can follow the location of the failed device.

TVH pointed out that predictive maintenance measures have saved them 30% of maintenance costs, and also made the ratio of safe operation time of machinery and equipment higher.

-

Automation of repetitive tasks

There are already many signs in 2018 that factory facilities are implementing more automation. Automation is particularly valuable in repetitive tasks because it can reduce employee fatigue and reduce human errors due to a lack of consistency.

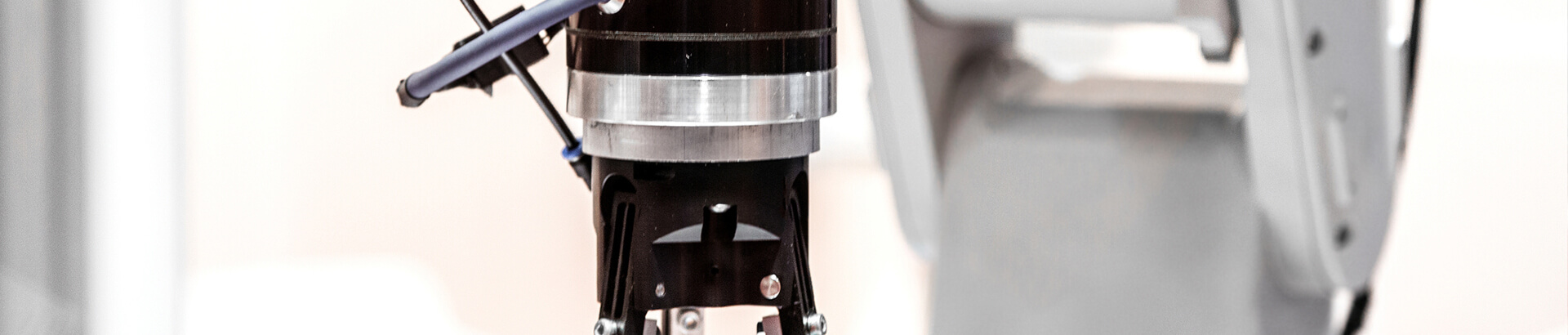

Automation is mainly used to supplement manpower shortage, not to replace manpower. The Dynamic Group, which develops precision molds and injection molded components, chose to supplement the production capacity of the three production lines with a collaborative robot due to insufficient manpower in the development of production lines for thermal sensing components in the past.

-

Data visualization

It is inevitable that the company will encounter a bottleneck in its operation, but it is uncertain how to solve it. Shimadzu Corporation, which manufactures medical and industrial measuring instruments, also finds production line defects that are difficult to predict and solve. To reduce such burdens, Shimadzu Manufacturing can introduce A platform for visualizing the production line process and dispatching people to supervise and discover the limits of the production line.

Six months after the introduction of the platform, Shimadzu said that it has reduced production time by 320 hours and increased productivity by 15%; the company also said that the overall operation perspective has been more abundant than in the past and can analyze components from multiple factories at the same time.

Enterprises will often hesitate to adopt new technologies, but the above cases are sufficient proof that in 2018, more companies will further adopt smart technology to break through the original operating limits and expand their scale with sufficient budget and demand-oriented circumstances.

.jpg)