The third-generation semiconductor is currently the hottest topic in the high-tech field, and plays an indispensable role in the development of 5G, electric vehicles, renewable energy, and Industry 4.0. What is the third generation of semiconductors? In this article, we will take you to understand this key technology that can affect the future of the technology industry from the most simple and comprehensive perspective.

As the world enters the era of IoT, 5G,

green energy, and electric vehicles, Wide Band Gap (WBG) semiconductors that

can fully demonstrate high-voltage, high-temperature, and high-frequency

capabilities and meet the requirements of current mainstream applications for

high energy conversion efficiency Beginning to become the darling of the

market, semiconductor materials opened the prelude to the new era of the

third-generation semiconductor.

What is the Third Generation

Semiconductor and Wide Energy Gap?

When it comes to the third-generation

semiconductors, let’s first briefly introduce the first and second-generation

semiconductors. In the field of semiconductor materials, the first generation

semiconductor is "silicon" (Si), the second generation semiconductor

is "gallium arsenide" (GaAs), and the third generation semiconductor

(also known as "wide energy gap semiconductor", WBG) is "Silicon

carbide" (SiC) and "gallium nitride" (GaN).

The "energy gap" in wide-gap

semiconductors, in the most vernacular way, represents "one energy

gap", which means "the minimum energy required to make a

semiconductor go from insulating to conducting."

The silicon and gallium arsenide of the

first and second generation semiconductors are low energy gap materials, with

values of 1.12 eV and 1.43 eV respectively. The energy gap of the third

generation (wide energy gap) semiconductors, SiC and GaN reach 3.2 eV and 3.4

eV, respectively. Therefore, when encountering high temperature, high voltage

and high current, compared with the first and second generation, the third

generation semiconductor will not easily change from insulating to conductive,

the characteristics are more stable, and the energy conversion is better.

The Third-Generation Semiconductor Myth

With the advent of the era of 5G and

electric vehicles, the demand for high-frequency, high-speed computing, and

high-speed charging of technology products has increased. The temperature,

frequency, and power of silicon and gallium arsenide have reached the limit,

and it is difficult to increase the power and speed; once the operating

temperature exceeds 100. The first two generations of products are more prone

to failure, so they cannot be used in more severe environments. In addition,

the world has begun to pay attention to the issue of carbon emissions, so the

third-generation semiconductors with high energy efficiency and low energy

consumption have become the new darling of the times.

The third-generation semiconductors can

still maintain excellent performance and stability at high frequencies, and at

the same time have the characteristics of fast switching speed, small size, and

rapid heat dissipation. The volume of the module and cooling system.

Many people think that third-generation

semiconductors, like advanced manufacturing processes, are accumulated from the

technologies of first- and second-generation semiconductors, but this is not

the case. From the picture, these three generations of semiconductors are

actually in a parallel state, and they develop their own technologies. Since

China, the United States, and the European Union are actively developing

third-generation semiconductors, Taiwan, one of the keys to the semiconductor

industry chain, is bound to keep up with this trend.

SiC and GaN Have Their Own Advantages and

Different Development Fields

After understanding the differences of the

first three generations of semiconductors, we then focus on the materials of

the third generation semiconductors - SiC and GaN. The application fields of

these two materials are slightly different. At present, GaN components are

often used in fields with voltages below 900V, such as chargers, bases Taiwan,

5G communication-related and other high-frequency products; SiC is a voltage

greater than 1,200 V, such as electric vehicle-related applications.

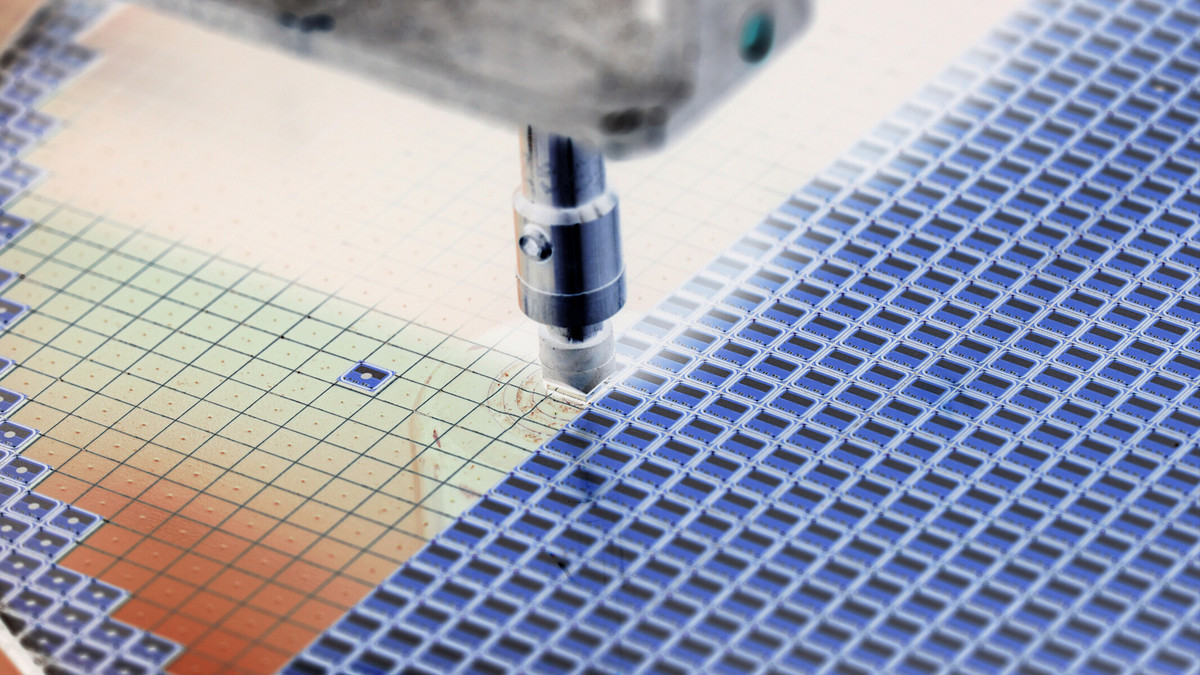

SiC is composed of silicon (Si) and carbon

(C), which has strong bonding force and is thermally, chemically, and

mechanically stable. Due to the characteristics of low loss and high power, SiC

is suitable for high-voltage and high-current application scenarios, such as

Electric vehicles, electric vehicle charging infrastructure, solar and offshore

wind power and other green energy power generation equipment.

In addition, SiC itself is a

"homogenous epitaxy" technology, so it has good quality and good

component reliability. This is also the main reason why electric vehicles

choose to use it. In addition, it is a vertical component, so the power density

is high.

Today, the battery power system of electric

vehicles is mainly 200V-450V, and higher-end models will develop towards 800V,

which will be the main market for SiC. However, SiC wafers are difficult to

manufacture, and the source crystals for crystal growth are highly demanding

and difficult to obtain. In addition, the crystal growth technology is

difficult, so mass production is still not possible at present, which will be

described in more detail later.

GaN is a lateral element and is grown on

different substrates, such as SiC or Si substrates. It is a "hetero-epitaxy"

technology. The quality of the GaN film produced is poor. Although it can be

used in consumer areas such as fast charging, it is used in electric vehicles.

Or there are some doubts in the industry, and it is also the direction that

manufacturers are eager to break through.

The application fields of GaN include

high-voltage power components (Power) and high-frequency components (RF). Power

is often used as a power converter and rectifier, while the commonly used

Bluetooth, Wi-Fi, and GPS positioning are among the applications of RF

components. one.

In terms of substrate technology, the

production cost of GaN substrates is relatively high, so GaN components are all

based on silicon. GaN-on-SiC) two wafers are fabricated.

Commonly heard GaN process technology

applications, such as the above-mentioned GaN RF RF components and Power GaN,

all come from GaN-on-Si substrate technology; as for GaN-on-SiC substrate

technology, due to the difficulty of manufacturing silicon carbide substrates

(SiC), The technology is mainly in the hands of a few international manufacturers,

such as Cree, II-VI and ROHM.

Although the third-generation

semiconductors have better performance in terms of performance, their technical

threshold is higher, and not all electronic components and technical

applications require such high performance, so the third-generation

semiconductors will not completely replace the previous ones. After the second

generations have been replaced by the old, in principle, the third generations

will each play an important role in different fields. Basically, the first

generation will focus on logic ICs, memory ICs, micro-component ICs and analog

ICs used in computers and consumer electronics, the second generation will

focus on RF chips in the field of mobile communications, and the third

generation will focus on The biggest driving force comes from the fields of 5G,

IoT, green energy, electric vehicles, satellite communications and military,

and high-frequency radio frequency components and high-power power

semiconductor components are the main applications. Among them, 5G and electric

vehicles are regarded as the biggest drivers and driving forces to accelerate

the development of third-generation semiconductors.

.jpg)