Vietnam is one of the countries in Asia and the ASEAN that is most actively promoting regional economic integration. So far, it has passed and implemented 10 bilateral trade agreements, including ASEAN and Japan, South Korea, Chile, and the Eurasian Economic Union.

Developing market-Vietnam

Vietnam is a developing country. The self-sufficiency rate of metal processing and industrial products is less than 10%. Therefore, more than 90% need to rely on imports. Among them, the import value of machine tools and equipment parts accounts for the largest proportion of the total import product value.

The manufacturing capacity of global industries in China was previously affected by the US-China trade war and the COVID-19 epidemic, which has accelerated the pace of the industry’s decentralized production base. Machine tool manufacturers expect that the tide of setting up factories in Southeast Asia will emerge from the third quarter. Restricted labor shortages, rising land, and labor costs, and other issues will accelerate the shift of factories to smart manufacturing and automation, and related Taiwanese factories will also benefit from this.

Whether it is the US-China trade war or the epidemic, the market is suffering from uncertain factors. The US-China trade war has caused companies to encounter bottlenecks in their production plans in China, and the COVID-19 attack has caused manufacturers to make Chinese manufacturing energy instantly zero. Dispersing production bases and even moving major production capacity out of China has become a necessary change for the industry. After the epidemic slows down, enterprises will accelerate the pace of building a second production base, and the wave of factory construction in Vietnam will also begin to emerge from the third quarter.

Due to its geographical location close to mainland China, it is easier to obtain supply chain components, and it is politically stable. It has a Confucian culture and customs close to China, as well as the advantages of young workers. Recently, it has attracted major brands such as Apple and Samsung to supply by name. The chain went to the local factory to set up.

However, under the recent upsurge of investment in Vietnam, factories are vying for labor, wages are rising rapidly, shortage of labor is serious, and land prices continue to rise, all of which put pressure on business operations.

Machine tool manufacturers believe that problems such as limited labor shortages, rising land and labor costs, and the long-term trend of industrial automation remain unchanged. When the epidemic is over, they are expected to accelerate the introduction of smart manufacturing or industrial automation by Vietnamese factories. To help promote the growth momentum of machine tool manufacturers, some component manufacturers have begun to embark on the brand road, and at the same time shape their own corporate culture and sales channels.

The ASEAN market is growing

Di Chun Iron Work, Accelerates Its Deployment in The ASEAN Market

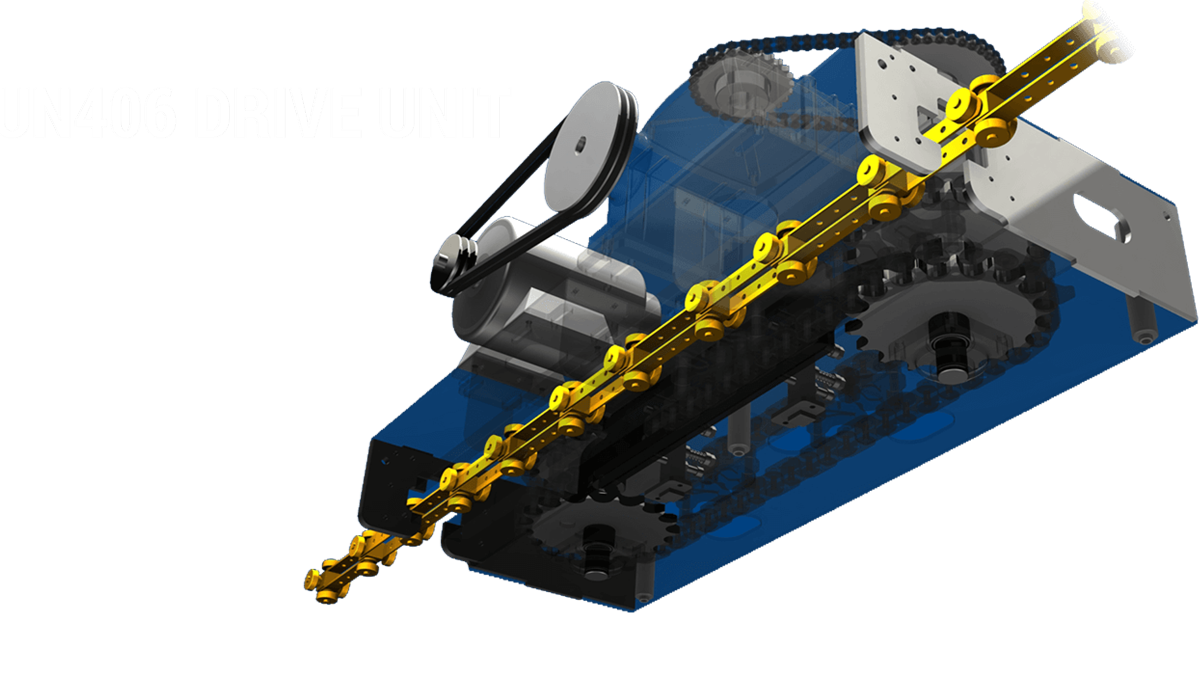

Di Chun has been in business for more than 40 years and has continued to cultivate in the precision machinery components industry. Currently, various types of hydraulic cylinder and power chuck have achieved good sales results in the European, American, and Japanese markets, and they have ranked first in the cross-strait markets. Large-scale vertical and horizontal lathe manufacturers in Taiwan and China are the company’s main customers and have consolidated Di Chun’s business operations. However, the company has not stopped its pace of development and is fully pursuing a "good plus good" business state. Among them, in terms of productivity improvement, it has been actively working on shortening the production process and constructing high-efficiency automated production lines to achieve multiple goals such as increasing production capacity and supply flexibility, and shortening delivery time.

In the pursuit of excellence in quality, senior executives of Di Chun revealed that in the future, they will also use the Internet and big data to collect various data in the product testing process and conduct further statistical analysis. In response to unsatisfactory test results, corrections and retests are made, with precise data analysis, to improve the quality of the product and achieve zero defects.

After gaining a foothold in the cross-strait markets, Di Chun will speed up the deployment of ASEAN and European and American markets starting this year. Vietnam's machine tools mostly rely on imports, and Taiwan is Vietnam's fourth-largest importer of machine tools. In addition, the country's economic growth rate this year is estimated to reach 6.7%, indicating that Taiwan's machine tools have great potential for local development. In addition to attacking the ASEAN and European and American markets, Di Chun has repeatedly achieved good results in product development. The vice-chairman of Di Chun stated that in addition to sticking to the traditional standard hydraulic chuck and rotary hydraulic cylinder market, in order to meet industry development and customer needs, in recent years, it has successively released 3-jaw draw down power chuck and V-300RA anti-chip/waterproof power chuck. MRR: the design of high-speed and lightweight can reduce spindle loading which is suitable for Vertical Lathe; MRA: the design of high-speed and lightweight can reduce spindle loading which is suitable for vertical lathe and applied to tubing machinery of small pneumatic chucks and other products.

If you are interested in Di Chun Iron Work Co., Ltd. products, please contact them right away.