It's that time of year again, check out the predictions for the most promising emerging technology trends to watch for in 2022. Pay close attention to the following topics as they will be covered in details to see what is happening around the globe.

Which technologies have the most momentum in an accelerating world? We identified the trends that matter most. Continued from the last article of “2022 Technology Industry Pulse”, here are some more to mention.

Low-orbit satellites have become a new battlefield for global satellite operators, and 3GPP has also included non-terrestrial wave communications for the first time:

The 3rd Generation Partnership Project (3GPP) was released for the first time, and the frozen version of Release 17 will be released in 2022. For the first time, non-terrestrial (NTN; Non-terrestrial Network) communication will be included as part of the 3GPP standard. This is a very important milestone for the communications industry. Previously, mobile communication and satellite communication were two independent development industries, so the upper, middle and lower reaches of the two industries were different. However, after 3GPP was incorporated into NTN, the two industry sectors not only gained more opportunities for interaction and cooperation, but were also expected to create a new industrial pattern. With the active deployment of low-orbit satellites, SpaceX in the United States has the largest number of applications for launch. Other major satellite operators include Amazon in the United States, OneWeb in the United Kingdom, and Telesat in Canada. Low-orbit satellite communication emphasizes that signal coverage is not limited by terrain, such as mountains, seas, deserts, etc., and can complement mobile communication 5G. 3GPP Rel-17 is expected to also direct NTN planning towards Low-orbit satellite communications in 2022, with the output value of the global satellite market expected to benefit from this increased developement.

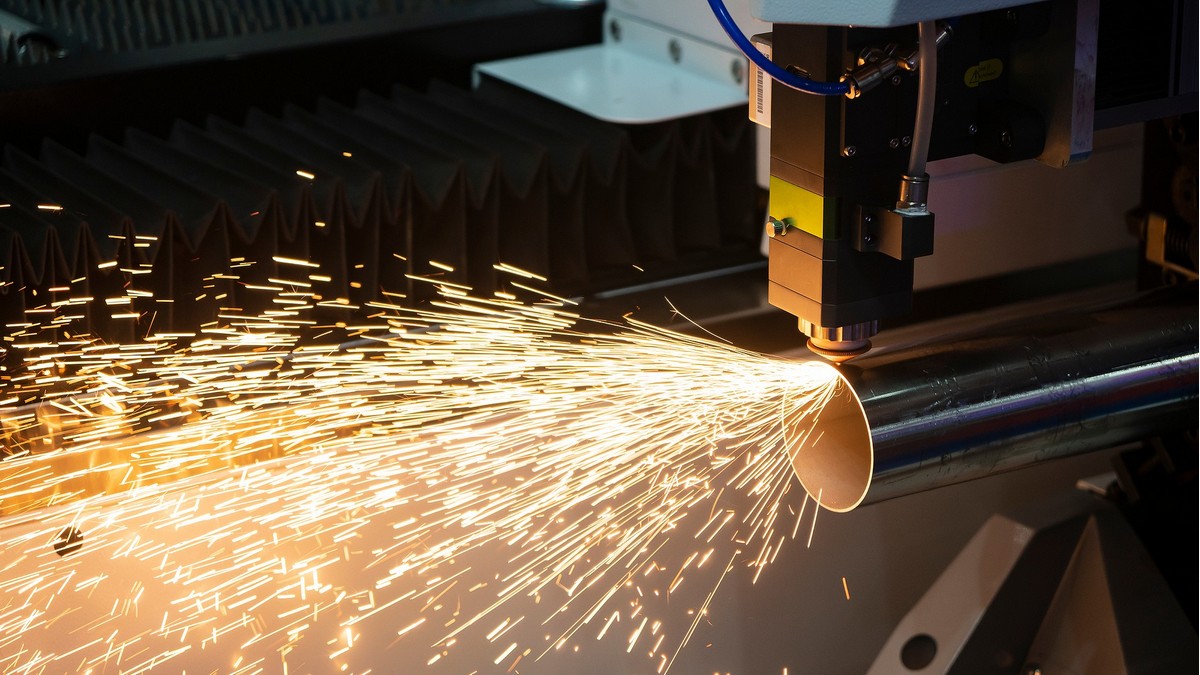

Create a metaverse from digital twins, and start smart factories:

The post-pandemic new normal continues to push up the demand for non-contact and digital transformation, so that the Internet of Things will focus on strengthening the Cyber-Physical System (CPS) in 2022. By combining 5G, edge computing, AI and other tools, valuable data can be extracted from massive data and analyzed to achieve intelligent autonomous prediction. With the current CPS format, digital twins are used in key vertical fields such as smart manufacturing and smart cities. The former can simulate design, testing and production processes, and the latter can monitor key assets and assist in decision-making. With the real environment becoming more complex, and the interaction between multiple fields increasing, devices that can accommodate these expansions will need to be used if further deployment of digital twins is to be promoted. A comprehensive, virtual space - metaverse is expected to be built with a framework that more intelligently, completely, instantly and safely mirrors the physical world. Visionary Smart factories will take the front line in driving the use of sensors, acoustics, environmental information collection, platform-level AI accurate analysis of computing power, and technological innovations such as blockchain to ensure data credibility.

Import AI computing and increase the number of sensors, AR/VR strives for a comprehensive immersive experience:

The epidemic has changed people's life and work situations, accelerated the willingness of enterprises to invest in digital transformation, and led to the introduction of new technologies. As a result, the adoption rate of new AR/VR applications such as virtual meetings, AR remote collaboration, and simulation design has also increased. On the other hand, in addition to game applications, various remote interactive functions, brought about by virtual communities, will also become important applications for manufacturers to develop the AR/VR market. Hardware development will adopt low-price strategies and application scenario increases, that will significantly expand the AR/VR market in 2022, prompting the market to pursue more realistic AR/VR effects. For example, using more types of sensors to provide more real data, using software tools that create more realistic application services, and introducing AI computing to assist in functions such as eye tracking, are options manufacturers such as Oculus, Sony are incorporating into future products. In addition, various haptic feedback effects are being provided in hardware, such as controllers or wearable devices, to improve the user's sense of immersion.

Automatic driving, solving pain points such as automatic parking, (AVP) will become a popular development focus:

Autonomous driving technology will be implemented in a way that is closer to real life experience. It is expected that the unmanned automatic parking (AVP) function of SAE Leve4 will become an important option for high-end vehicles with automatic driving function in 2022. Relevant international standards are in formulation, and this function is being actively developed. However, this function will vary depending on the equipment of the vehicle, resulting in restrictions such as for fixed/unfixed routes, private/public parking spaces, etc. The conditions of the parking lot, such as completeness of signs and the networking environment, will also affect the availability of AVP. When this function is executed, the distance between people and vehicles will be set by local regulations. Since the technical features of car manufacturers are different, the computing programs on the vehicle can be coordinated with the computing required for the generation of parking routes via cloud computing. However, cloud computing requires a well-developed networking environment to execute AVP. Other applications such as Vehicle-to-everything (V2X) and high-precision maps will also affect the application scope of automatic parking, and there are many AVP solutions being developed at this time.

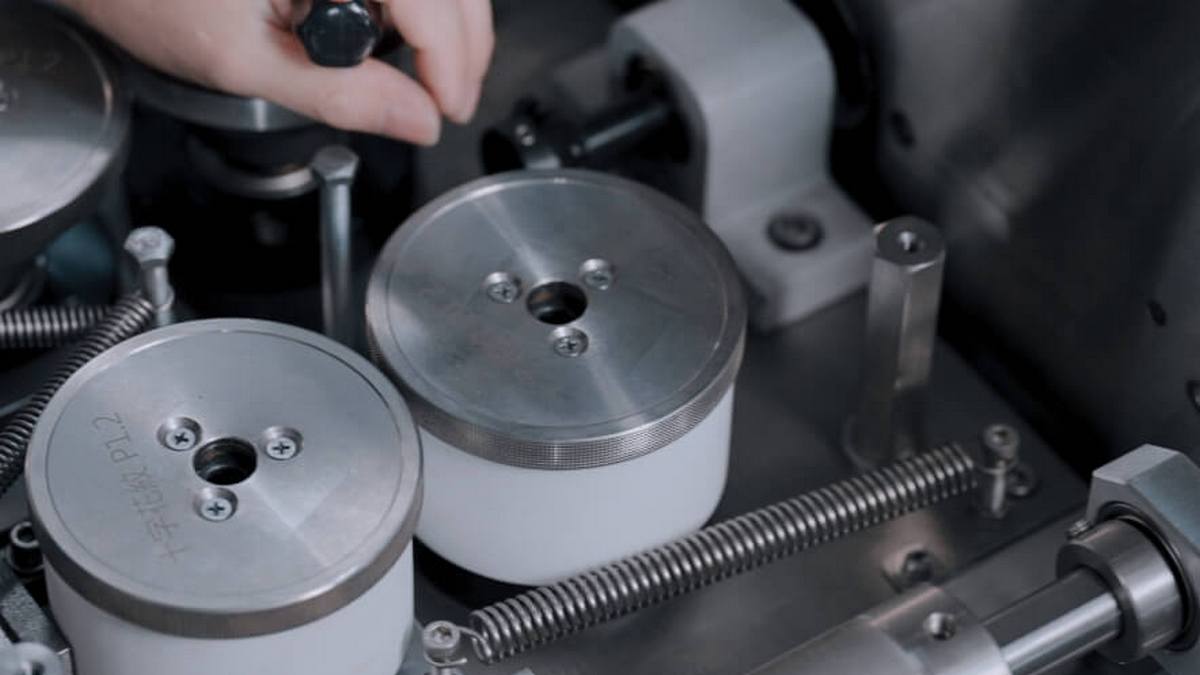

In addition to continuing to expand production capacity, the third-generation semiconductors are developing towards 8-inch wafers and new packaging technologies:

With countries gradually banning the sale of fuel vehicles from 2025 to 2050, global sales of electric vehicles increase. Along with this, the market share for SiC and GaN components and modules will also increase. Energy conversion systems and terminal applications such as 5G communications are growing rapidly, driving the third-generation semiconductor market. This in turn drives the sales of SiC and Si substrates required for third-generation semiconductors. However, due to the current, relatively limited production and research and development of substrates, the supply of SiC and GaN wafers is still limited to 6 inch wafers, so supply shortages are expected to continue for some time.

In this regard, substrate suppliers such as Cree, II-VI and Qromis plan to expand production capacity and increase the area of SiC and GaN wafers to 8 inches in 2022, hoping to gradually alleviate the gap in the third-generation semiconductor market. On the other hand, foundry companies such as TSMC and World Advanced (VIS) are trying to cut into GaN on Si 8-inch wafer manufacturing. IDM companies such as Infineon will release a new generation of Infineon Trench SiC device energy-saving architecture, while the communication industry Qorvo have proposed a new GaN MMIC Copper Flip Chip package structure for the defense field.

.jpg)