The electronics industry categorizes LED technologies according to the size of the LED chip. For example, an LED chip that is less than 150 μm is called a mini LED; an LED chip less than 50 μm is called a micro LED. As the size of LED chips becomes smaller and smaller, the structure of display panels will also change accordingly.

When the size of an LED chip is as small as the pixel, each pixel corresponds to one micro LED chip. A micro LED emits light by itself, so it can control the brightness and color of the pixel simultaneously. The micro LED does not require the liquid crystal layer and filter structure of traditional LCD screens.

The screen structure of a micro LED is close to that of an OLED. Both have self-illumination of pixels, simple structure and high luminous efficiency. However, the material life of micro LED is much higher than that of OLED, and its stability is also stronger.

From the perspective of technological maturity, because production costs are still high, the micro LED has a ways to go before it will see large-scale production. OLED faced this cost challenge in its early years of development. Although the cost of a large OLED screen is still much higher than that of an LCD screen, it has reached a standard that can be accepted by most home users.

Judging from past experience, as micro LED technology matures, will OLEDs and LCDs be replaced? Perhaps the answer is not that simple.

Micro LEDs Are Still a Long Way from Making Big Screens

During the early stages of development, it was difficult to apply micro LEDs to large panels. Just like with OLEDs, the production of large-panel, micro LEDs has been greatly limited by yield and cost.

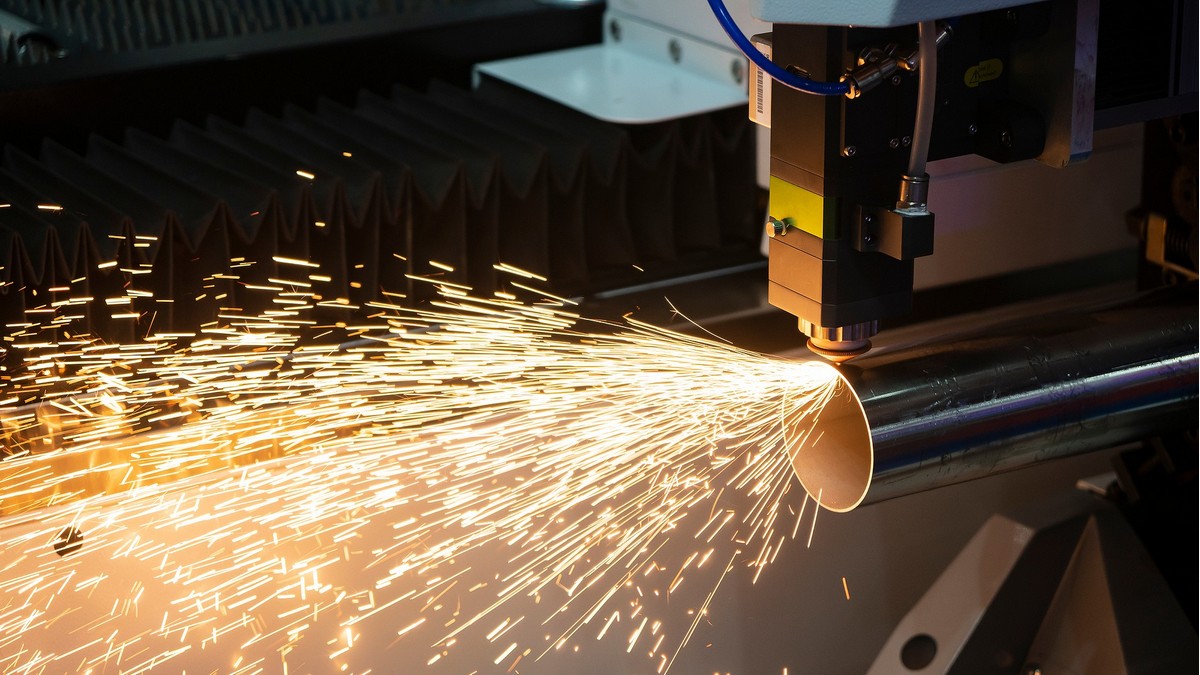

LED chips are becoming smaller, and their value is becoming greater than expected. During the manufacturing of micro LEDs, the wafer eventually needs to be transferred to the back plane of the screen. If the resolution of the screen is 1,920 × 1,080, the number of pixels on the screen exceeds 2 million. Because each pixel consists of three sub-pixels of red, green and blue, there are 6 million micro LED chips on this micro LED screen.

With contemporary semiconductor manufacturing processes, it is not difficult to grow 6 million micro LED chips on a wafer, the difficult thing is to transfer these 6 million micro LED chips to the backplane. The industry calls this transfer process a mass transfer. Even the high-end mini LED screens on the market, such as the 2021 iPad Pro 12.9", have only 10,000 mini LEDs in the backlight layer. Therefore, mass transfer is a major difficulty in micro LED manufacturing.

Different solutions exist on the market for the mass transfer problem. Among them, the two main categories are: whole-piece transfer and batch pick-and-place. Whole-chip transfer is suitable for small-sized screens, because the screen panel is small enough, so it can be transferred as a whole. The technology of picking and placing in batches is more difficult, and large screens can only use this solution to achieve mass transfer.

Mass transfer isn't the only technical hurdle in micro LED panel manufacturing, but it's the watershed that constrains micro LED manufacturing for large and small screens. Of course, how big a screen can be, depends largely on cost, as demonstrated by Samsung and Sony Micro; LED large-screen TVs all cost over a million US dollars.

At display technology exhibitions in recent years, the micro LED products being displayed by manufacturers have become more pragmatic. At this year's SID Display Week, the micro LED products displayed by Tianma Microelectronics, AUO, Chitron Technology and other manufacturers were all aimed at small screen applications such as automotive dashboards and electronic paper. Of course, even if the display is a large-screen application, the current parameter advantages have not greatly surpassed OLED/LCD.

Opportunities At This Stage

The obvious advantages in structure determine the characteristics of micro LED's high pixel density, high brightness, high contrast, and fast response. High pixel density, high brightness and high contrast can be significantly perceived from the structure. In previous prototype product demonstrations, manufacturers have demonstrated displays with tens of thousands of ppi (pixels per inch) pixel density.

Since the micro LED chip is small at the pixel level, it can display true black with no light from a single pixel. At the same time, the ultra-small LEDs in micro LED displays are more efficient in converting electricity into photons, and micro LEDs are brighter than OLEDs and LCDs; based on higher electron mobility, micro LEDs can switch at nanoseconds (ns) grade. Due to the limitations of the manufacturing process, the micro LED is only suitable for small screens in the early stage, for example, it is especially suitable for AR/VR applications, including goggles for entertainment.

AR/VR's requirements for display brightness, contrast, pixel density and response are much higher than those of mobile phone consumer electronics products. It is technically difficult for LCD and OLED to meet the needs of such applications. Many consumers have reported that the current AR/VR applications are prone to dizziness and lack of immersion. In fact, this is largely limited by the technology itself of LCD and OLED. The application of micro LED in the field of AR/VR has significantly overcome this problem. Perhaps the key to the future development of AR/VR will depend on breakthroughs in micro LED technology.

In addition, the miniaturization of micro LED chips is conducive to the softness and transparency of the panel. Chitron Technology has demonstrated a soft + transparent screen. "Softness", "transparency", and "foldable" have been the hotspots of screen display technology over the past two years, and to some extent are the keys to achieving industrial breakthroughs.

Analysts have learned from LED chip manufacturers upstream in the panel supply chain, that early applications of micro LEDs will focus on wearable devices, AR, VR, and automotive small screen products. This is logical from a technical point of view.

It is worth mentioning that although the micro LED has many technical advantages over LCD/OLEDs, some of these advantages are still in the theoretical stage. One representative advantage is the external quantum efficiency (EQE) - which is the luminous efficiency. Compared with LCDs, the screen structure of micro LED displays does not include the liquid crystal, color filter, and polarizer. Compared with OLEDs, they do not require complex packaging technology. In theory, the luminous efficiency of micro LED displays is much higher than LCDs or OLEDs.

However, the extremely small size of micro LEDs makes them very susceptible to sidewall effects - an engineering issue that arises in the manufacturing process. So the actual EQE of micro LEDs is extremely low, and may not even be comparable to LCD or OLED. The existence of sidewall effects also makes it more difficult for micro LEDs to produce ideal large-screen applications. Therefore, the existing micro LED solutions on the market are far from reflecting the technical advantages of micro LED itself.

Complementary Application with LCD/OLED

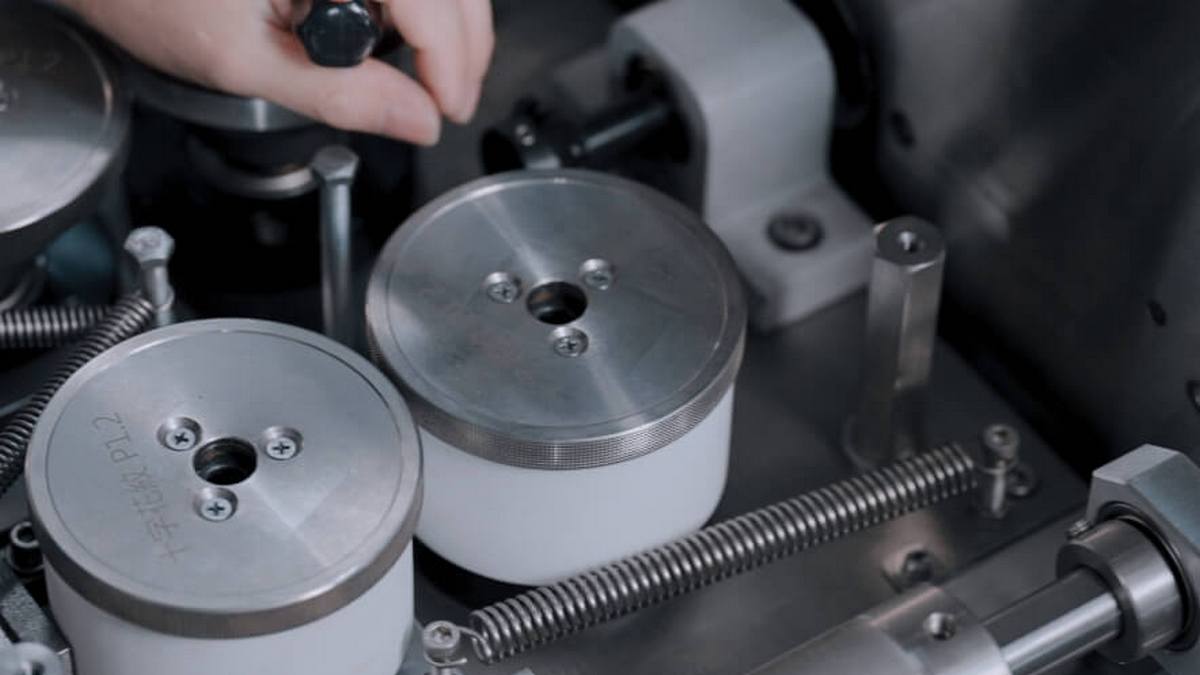

Various technical challenges of micro LEDs are difficult problems that many market players are trying to solve. The technical characteristics of micro LEDs will also determine the changes that will need to be made in the display industry in the future. The miniaturization of micro LEDs will further tilt panel manufacturing towards semiconductor technology.

CMOS is limited to small size screens because CMOS faces cost issues when being produced for large-size screens. Therefore, amorphous silicon and low temperature polysilicon TFTs are still the main technologies being used for the manufacture of large-screen micro LEDs.

Early observations of micro LEDs from Hendy Consulting suggest that there may be a value shift in the micro LED supply chain. This is determined by its technical characteristics. As micro LEDs gradually move closer to IC manufacturing, they challenge the status of traditional panel manufacturers.

It is expected that there will be four possible developments in the future of the display industry: the first is that traditional industry players (such as Samsung and LG) will remain at the center of the industry, but their value will be diluted; the second is that manufacturers with vertical integration capabilities, such as LuxVue, (acquired by Apple), and Glo AB (invested in by Google), will occupy dominant positions in the micro LED world; the third is that the composition of the new industrial structure and its value may be transferred to LED chip manufacturers, semiconductor manufacturers and enterprises holding key IP (multi-party cooperation); the fourth is that micro LED may not become the mainstream of the market.

Over the past two years, micro LED related investments are increasing on a large scale in South Korea, Taiwan, and China, with upstream and downstream companies in the industry actively cooperating. Before 2018, the market players of micro LED were independent, and different companies were taking very different technical approaches to development.

Considering that micro LED manufacturing technology may need to be application-oriented, customized manufacturing processes will need to be developed which may be very different from LCD/OLED manufacturing technologies. Independent management is not conducive to the market development of micro LED, as there are various technical approaches being taken which have no common standards for technology. Although the industry is in its early stages of development, beginning in 2020, there has been a lot of cooperation in the industry, which is a sign that micro LEDs are maturing.

The market variables are very large, and ESMC analysts believe that the industry development direction analyzed by Hendy Consulting may be too simplistic. In their view, not only the changes in market investment and cooperation trends over the past 1-2 years, but also the possibilities for long-term development of micro LEDs in the future, point to many unforeseen challenges and possibilities.

Just as OLED did not completely replace LCD in the past, as a technology with development potential in small screens and AR/VR in its early stages, micro LED is very likely to coexist with OLED and LCD for a long time. But applications of the three will be different. For example, micro LED will focus on the small screen and AR/VR market, eating into the value of OLED and LCD in the high-end market. Although the market size of OLED and LCD will shrink, the three will form a subtle complementary relationship in terms of technology and market, rather than micro LED replacing OLED or LCD.

.jpg)