In recent years, Taiwan’s "mechanical transmission equipment industry", "pumps, compressors, stopcock and valve industry", "other general equipment and machinery", and other relevant industries have increased their production indexes, mainly because of the active demands for smart automation equipment which has driven the increase in overall output.

What is General Equipment and Machinery Manufacturing Industry?

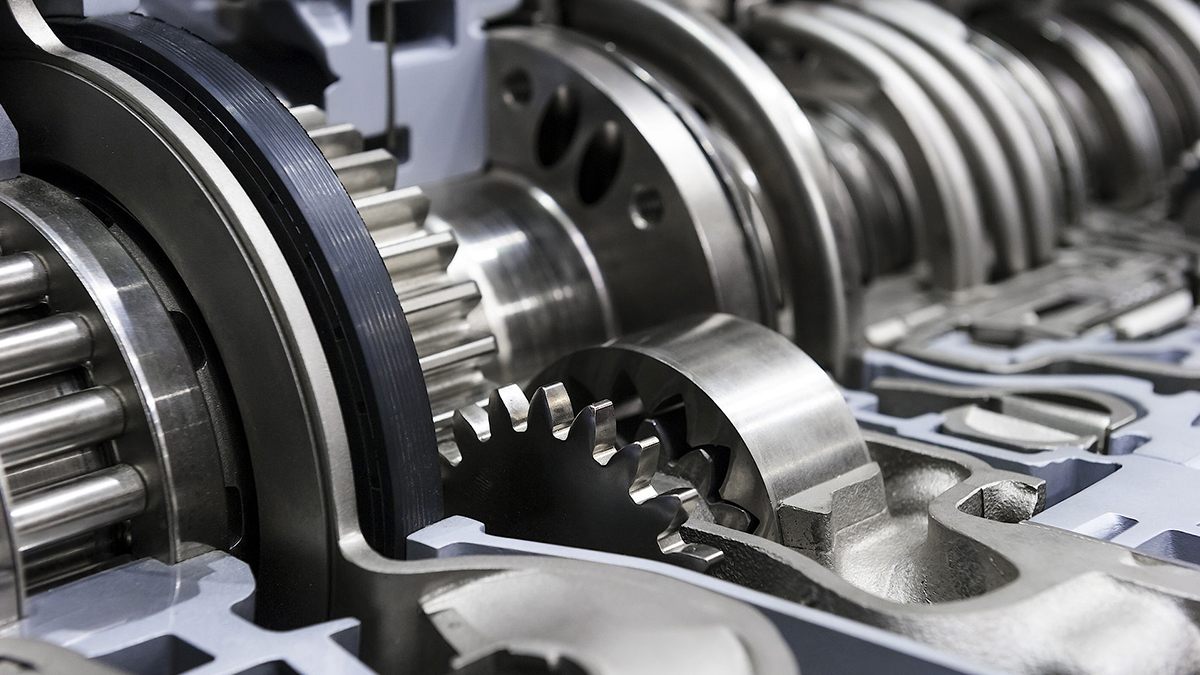

The general equipment and machinery manufacturing industry is defined as: “The manufacturing of equipment widely used in prime movers, fluid transmission equipment, pumps, compressors, stopcock, valve, mechanical transmission equipment, conveying machinery equipment, office machinery equipment, pollution prevention equipment, power hand tools, etc.,” The manufacturing of general equipment and machinery required for the operation processes are also included in the general equipment and machinery manufacturing industry.

- Prime mover manufacturing industry: Any industry engaged in prime mover manufacturing

- Fluid transmission equipment manufacturing industry: All industries engaged in fluid transmission equipment manufacturing

- Pump, compressor, stopcock, and valve manufacturing industry: Any industry engaged in the manufacturing of pumps, compressors, stopcock, and valve

- Mechanical transmission equipment manufacturing industry: Any industry engaged in the manufacturing of mechanical transmission devices and their parts

- Conveying equipment and machinery manufacturing industry: Any industry that engages in the manufacturing of goods conveying and handling equipment

- Business equipment and machinery manufacturing industry: Any industry engaged in the manufacturing of business equipment and machinery

- Pollution prevention and control equipment manufacturing industry: Any industry engaged in the manufacturing of pollution prevention and control equipment

- Power hand tool manufacturing industry: Any industry engaged in power hand tool manufacturing

- Other general equipment and machinery manufacturing: Any industry that engages in the manufacturing of other general equipment and machinery

The general equipment and machinery are products designed and developed for comprehensive mechanics, fluid flow, thermodynamics, electronics, mathematics, and material science. Due to their high versatility and wide range of uses, they are widely used in agriculture, industry, and other industries. They provide important support and a foundation for promoting industrial development.

The general equipment and machinery manufacturing industry is an important development axis of traditional industries. It has industrial characteristics such as a short product cycle, high capital intensity, high dependence on professional manpower, and large-scale workshops. The production process is processing and assembly in nature, and the products are diversified and have different fields. With high independence and professionalism, it is a discrete manufacturing industry. The industrial structure is dominated by small and medium enterprises and mostly export-oriented. The main export countries are China and the United States. Because the industrial chain is closely connected, it has a complete supply chain system of upper, middle, and downstream, forming an intricate network division of labor, which is an important industrial element in Taiwan.

In terms of the number of profit-making businesses, since 2015, the number of general equipment and machinery manufacturers in Taiwan has not changed significantly, remaining at just above 6,000. The sales of Taiwan's general equipment and machinery manufacturing industry has remained at around 300 billion yuan for the past five years, indicating that Taiwan’s domestic general equipment and machinery manufacturing industry and sales have been affected by the international market. Due to changes in trade conditions and exchange rate fluctuations in Japan, South Korea, and other countries, the overall industry performance is stable.

Taiwan’s General Equipment and Machinery Manufacturing Industry

Taiwan’s general equipment and machinery manufacturing industry is mainly dominated by small and medium-sized enterprises. Coupled with the effect of industrial clustering, it has the advantages of high production flexibility, rapid response to market demand, and excellent processing expertise. However, due to the small scale of these enterprises, the limited investment in product innovation, research and development, channel expansion, and brand building has made the industry's international competitiveness limited. This which is a dilemma that the industry needs to overcome in the future.

In Taiwan's domestic demand market, low-price orders and vicious competition often occur in the same industry. In the past, many industrial players moved overseas to set up factories and develop, which became an obstacle to the domestic demand market. However, in the past two years, benefiting from the impact of the US-China trade war on the development of Taiwanese businessmen in China, some Taiwanese businessmen have successively returned to Taiwan to invest, which has driven the overall demand for general equipment and machinery manufacturing to increase and mobilized the domestic demand market.

In terms of international competition, export sales are the main source of income for the general equipment and machinery manufacturing industry. As the international economic and trade situation changes, the pressure of international competition is deepened, which has a significant impact on overall revenue. Facing countries such as China and South Korea competing for international orders with low prices, the revenue performance of the general equipment and machinery manufacturing industry has been challenged. Exchange rate fluctuations in various countries are also one of the factors that interfere with overall revenue performance. The exchange rate depreciation measures adopted by countries such as South Korea and other countries have made the Taiwan dollar stronger than other countries' currencies, thus eliminating the advantage of price competition and affecting the profitability of the industry.

Furthermore, Taiwan's general equipment and machinery are highly dependent on the Chinese market, which easily affects the profitability of Taiwan's general equipment and machinery. In 2015, China's red supply chain emerged. General equipment and machinery such as mechanical transmission equipment that had to be imported from abroad were transferred to China's local production and supplied to the Taiwan domestic market. This impacted Taiwan's overall export performance of general equipment and machinery. In the past two years, the US-China trade war has increased the demand for Taiwan manufacturing and equipment. The U.S.-China trade war and the U.S. tariffs imposed on China have promoted an international effect, benefiting Taiwan's general equipment and machinery manufacturing industry, thereby increasing overall industrial revenue.

The COVID-19 outbreak in 2020 caused many companies in China to stop work, weakening the demand for equipment and machinery in the Chinese market, and affecting Taiwan's general equipment and machinery exports. In recent years, the Taiwan government has vigorously promoted the new Southward Policy, and Taiwanese companies have successively deployed in Southeast Asia and South Asia markets such as Vietnam, Thailand, Indonesia, and India. The expanded factories and production lines will increase the demand for purchasing general equipment and machinery, which is expected to drive the overall growth momentum and reduce the risk of Taiwan’s long-term dependence on the market.

In addition, in response to the forthcoming of the Fourth Industrial Revolution, being intelligent is an important trend in the future of industrial development. All countries have drawn up relevant development strategies, such as Germany's development of "Industry 4.0", China's promotion of "Made in China 2025," and the Taiwan government’s "Smart Manufacturing." Various industries are gradually transforming towards smart factories and production lines. The general equipment and machinery manufacturing industry is the key to industrial upgrading. For example, mechanical transmission equipment and precision machinery are key components essential for operation.

Smart manufacturing is the developing trend of future industries. Taiwan’s general equipment and machinery manufacturing industry is also facing a period of industrial transformation. If it cannot keep up with the pace of global industrial upgrading and process optimization, it will soon lose its international competitiveness and greatly reduce its international gains. In order to continue expanding international exports, maintain stable growth momentum, and strengthen core competitiveness, industries will need to expand R&D capabilities and develop their human resources. However, Taiwan’s general equipment and machinery companies are mostly small and medium-sized, and product innovation R&D, high-end Resources such as manpower, and brand marketing are generally insufficient. The government currently promotes industry through subsidies or tax reductions, encouraging small and medium-sized enterprises to develop high-value-added innovative products and fill the gap in high-level manpower to facilitate future industrial transformation and upgrading.

In the face of fierce industrial competition and drastic changes in the international market, to avoid losing advantages in the torrent of industrial competition, government resources can be allocated to enrich R&D innovation and talent cultivation. This will inject new business capabilities into the company, leading to expanded domestic and global markets and enhanced international competitiveness.

.jpg)

.jpg)

.jpg)