- Showing results for

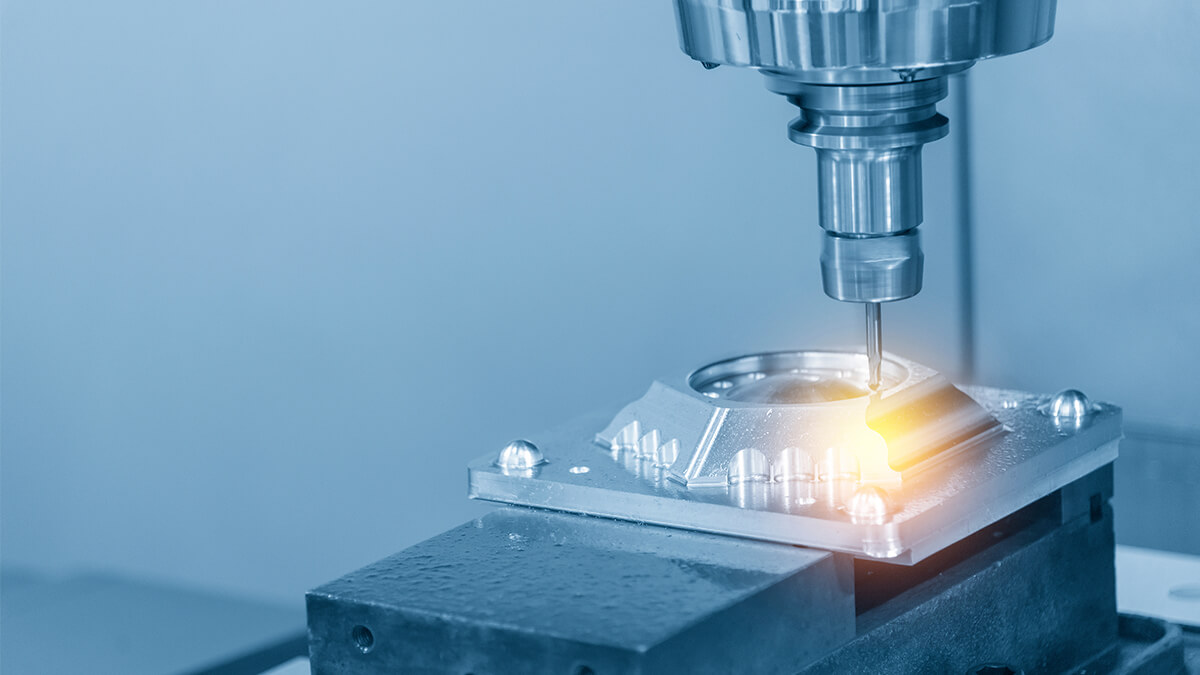

- Machine Tools Import

The Southeast Asian Manufacturing Alliance, initiated by Singapore, is mainly characterized by orderly and divided industrial zone planning. Singapore is a market entry hub and a high-tech development center.

2022-09-07 13:44:36

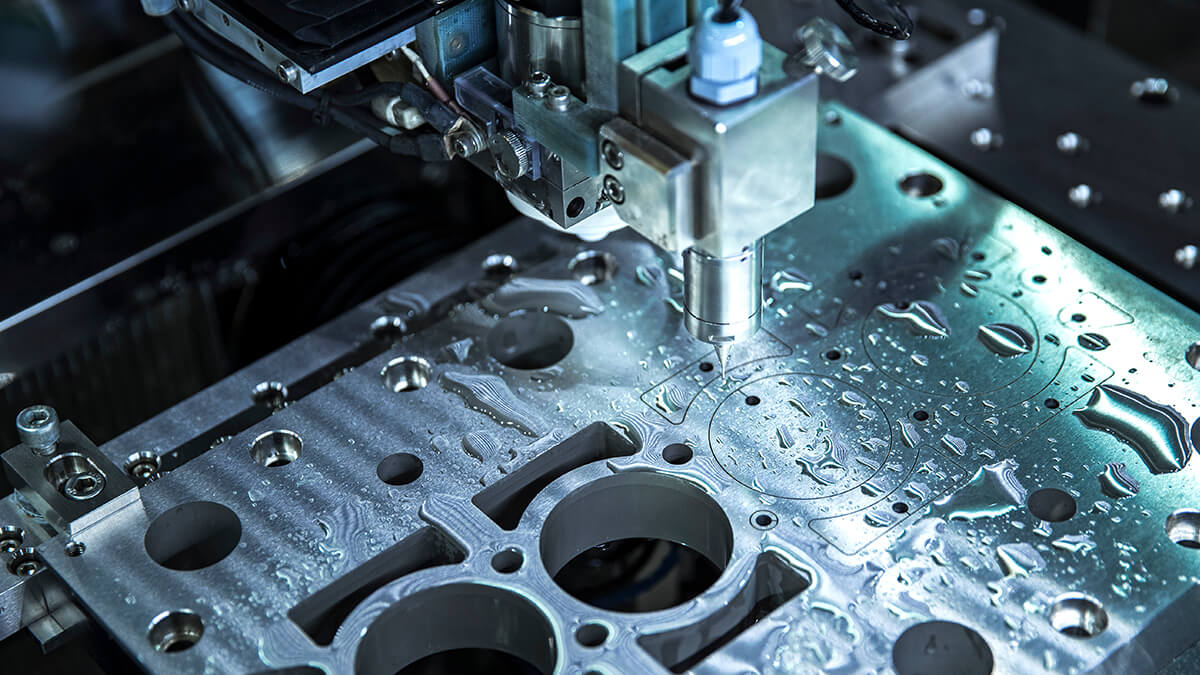

Germany is the second-largest producer of machine tools in the world, after China. Advanced German machine tool technology has led the development of the machine tool market.

2022-05-16 16:41:57

In the face of the epidemic, material shortages, lack of manpower, port congestion, and soaring shipping costs, market demand and the structure of the global supply chain has changed.

2022-03-03 10:01:49

Geographically, Turkey is a natural land bridge located on the east-west axis and the north-south axis. It connects European, Middle Eastern, African, and Central Asian markets, giving it great geographical and economic advantages. Holding this key global position, its central location creates an efficient and cost-effective export hinterland and market for major trading partners.

2021-08-03 09:22:42

The manufacturing industry occupies an important position in the British economy. Although the UK has declined in industrial scale, it still has some of the world’s top companies in steel, pharmaceuticals, biological breeding, aerospace, machinery, microelectronics, military, and environmental sciences, etc. All aspects are among the best in the world.

2021-06-03 17:27:47

South Korea is the world's sixth-largest machine tool producer and the world's fifth-largest machine tool consumer, with an average consumption of approximately US$4.33 billion. Among them, nearly 70% of the consumer market's demand is for products provided by local machine tool factories, and only close to 30% of the products must be imported from abroad.

2020-09-01 13:46:45

In recent years, Turkey has become a highly anticipated newly industrialized country with its brilliant GDP growth rate. It has also become Taiwan's third-largest export market for machine tools for many years.

2020-08-14 15:06:51

Looking back at the continuous fluctuations in the global manufacturing industry in 2019, the supply chain is in uncertainty, and the overall output value of Taiwan's machine tool components in 2019 will be affected.

2020-08-06 14:58:08

Looking back at the continuous fluctuations in global economic and trade conditions in 2019, the global economy is in a high degree of uncertainty, and the overall output value of Taiwan's machine tool industry in 2019 will be affected.

2020-08-06 14:32:38

According to the International Economic Forecasting Agency, the global economic growth of this year (2020) is almost the same as the growth rate of 2019. However, the impact of the covid-19 may affect the economy of various countries in the short term and even impact the industrial supply chain. The current situation of the international economy and explain the possible influence factors of the recent development of the North American market, including the US-Canada-Mexico Agreement, the US-Japan Agreement, the US-China trade war, etc., and then the development of the supply chain changes explore the outlook for the North American market.

2020-07-20 15:45:26

How to choose the rise of India's manufacturing industry and whether it can accelerate its growth will determine whether Taiwan's machine tool industry can find a new blue ocean in South Asia as expected.

2020-07-15 11:34:56

Japan is the third country in the world to establish a machine tool industry and realize industrialization after the United States and Germany.

2020-07-13 17:28:43

In 2019, the global machine tool is facing a severe test, and the market prosperity is not ideal.

2020-07-06 15:04:22

Affected by the two major economies of the United States and China, global trade trends have subsided, and the Asian economy has also suffered greatly.

2020-07-03 13:12:52

The world's major exporters of machine tools are concentrated in Asia, the European Union and North America. In 2019, the German machine tool market ranked Germany as the world's largest exporter. In 2019, the export of machine tools was 9.17 billion US dollars.

2020-06-11 15:23:17

Agree