Upstream component industry chain:

Hardware component products manufactured in the upstream of the electrical machinery industry include products such as various precision metal parts, automobile and motorcycle parts, bicycle parts, mechanical hardware parts, power tool gears, pneumatic gun nails, furniture nails, automotive thread products and rollers, stamping parts for machinery, etc.

Oil and air compressor components are used in hydraulic or air compressors used in automation equipment. Air compressors are mainly used to provide the compressed air required for the factory's processing. Electrical energy drives the motor that compress air into a closed reservoir to generate reserve kinetic energy for use by tools and equipment. A hydraulic press is a device that can convert fluid energy into linear mechanical force or motion. It uses special hydraulic oil as a medium and a hydraulic pump as a power source. By the action of the pump, the hydraulic oil enters the cylinder or piston through the hydraulic pipeline. There are several sets of seals that cooperate in the cylinder or piston. The seals at different positions are different, but they all have the function of sealing so that the hydraulic oil will not leak. Oil and air pressure-related parts such as hydraulic cylinders, hydraulic chuck tools, hydraulic tools, hydraulic pipe fittings, hydraulic joints, etc. are used extensively in the automobile and auto parts industries.

The stamped parts of mechanical equipment are parts made by a metal stamping process. The manufacturing method is to use molds and hammer tools to cut and bend them to shape them into the specified shape and size of the finished product. Casting, shearing, bending, cutting, drawing, molding, compressing, and other different processing types form objects into certain shapes. Plastic processing can be divided into stamping, forging, stretching, extrusion, and transformation. Among them, stamping OEM is the main one, and stamping OEM can be divided into shearing, bending, stretching, compression, and special processing.

Stamped components are widely used in various electronic products, and due to the different types, functions, and sizes of various electronic products, the material, thickness, and precision of the required components are also diverse.

Cast steel is the general term for the material used to make products obtained by casting molten steel as the raw material.

The target customers of upstream parts manufacturers in the electrical machinery industry are mainly the downstream machine tool and related equipment industries. The customer base of upstream parts manufacturers is larger than that of downstream manufacturers. Especially when the economic cycle is upward, parts manufacturers have high operational growth momentum.

Taiwan is a global leader in the bicycle parts industry. Benefiting from the continued expansion of bicycle assembly demand in Europe and the United States, front forks and headsets, frames, electric bicycle power system parts, derailleurs, and rims are all Taiwan's bicycle parts export products. Taiwan's bicycles are mainly exported to Europe with a market share of 43.2%, the United States with a market share of 29.8%, the European Union with a market share of 38.0%. In recent years, domestic manufacturers in Taiwan have been making continuous efforts in R&D and innovation, towards high-value development, which has also led to an increase in the average unit sales price year by year.

At present, the global bicycle industry is evolving, and with the rise of AI and IoT technologies, bicycle manufacturers are in line with the global market trend, and the transformation of the bicycle industry has also combined the two major technological trends to create a trend of smart riding. Traditional bicycles can be equipped with motors, batteries, control devices, and networking functions to become intelligent, electrically assisted bicycles. At present, with the transformation of traditional bicycles into electric bicycles, the electric bicycle market is rapidly and continuously growing. The pandemic has changed ways of life around the world. To maintain social distance, bicycles have become one of the best ways to commute and exercise. It will even become a new normal in the future.

The overall market's enthusiasm for bicycles has continued to increase, especially with an emphasis on zero contact and physical fitness. Taiwan's bicycle industry has developed with the trend, with the growth rate of E-bikes especially astonishing. This has allowed Taiwan's bicycle industry, which previously held an important global supply chain position, grow to meet the demand created under this wave of the pandemic. With the popularization of electric bicycles, focusing on environmental protection and green energy trends, electric bicycles are gradually replacing traditional bikes and meeting the modern need for short-distance travel and mobility.

The overall market's enthusiasm for bicycles has continued to increase, especially with an emphasis on zero contact and physical fitness. Taiwan's bicycle industry has developed with the trend, with the growth rate of E-bikes especially astonishing. This has allowed Taiwan's bicycle industry, which previously held an important global supply chain position, grow to meet the demand created under this wave of the pandemic. With the popularization of electric bicycles, focusing on environmental protection and green energy trends, electric bicycles are gradually replacing traditional bikes and meeting the modern need for short-distance travel and mobility.

Downstream machinery and equipment industry supply chain:

Downstream products of electrical machinery cover all kinds of machinery equipment and parts. Metal processing machinery-related manufacturers produce hydraulic presses, paper shredders, food machinery, machine tools, comprehensive processing machines, cutting center machines, machine tools, punching machines, electric power tools, printed circuits, plate drilling machines, tool grinding machines, wireless control systems, uninterruptible power system equipment, etc.

Products produced by industrial-specific machinery include sewing machines, baking machines, food and beverage automated production equipment, plastic injection molding machines, precision metallurgical grinding and processing machines, semiconductors, special gas pipeline engineering and production of vacuum process equipment chambers, industrial heavy-duty machineries such as boom lifts, loaders, excavators, drilling machines, forming machines and special machines for sheet metal processing, wireless control systems for green buildings, special machines and equipment for printers, labeling machines, conveying machinery and spare parts, mechanical transmission for vehicles. Equipment and spare parts include mechanical and electrical systems, hand tools (such as portable electric drills, chainsaws, portable electric engraving machines, portable electric disc grinders), vending machines, refrigeration, and air-conditioning equipment and parts, metal processing, etc. In the electrical machinery industry, various machine tools are mainly used to produce metal parts required by various industries and are the basic tools of the manufacturing industry.

Taiwan's electrical machinery industry has considerable international competitiveness due to manufacturers advanced technology, high quality, extensive choices of brands available, customization, and a continuous increase in global demand for intelligent automation. Taiwan's machine tool industry benefits from Taiwan's complete industrial supply chains. Taiwanese manufacturers are good at viewing the process from the user's point of view, and providing customers with systematic and integrated solutions.

In 2021, with the recovery of demand in China, the United States, and other markets, as well as the supply chain reshaping effect driven by the US-China trade war, orders for machine tools and component factories have increased significantly. The rise in prices, coupled with the lack of shipping containers leading to soaring freight costs, caused the machine tool industry to bottom out in 2020. But it is estimated that the global machine tool industry will return to its 2018 peak by 2024 or 2025.

80% of Taiwan's machine tool manufacturers are small and medium-sized enterprises, with limited R&D capabilities and funds for investing. It is quite difficult to integrate with information and communication systems, and there is an urgent need for transformation. With the evolution of mature industry 4.0 smart manufacturing technology, it is necessary for Taiwan machine tool manufacturers to step up the pace of deploying support solutions such as remote processing, remote monitoring, and AI production scheduling.

China is the largest producer of machine tools and the largest export market for Taiwan's machine tools. However, with the increasingly fierce competitiveness of Chinese enterprises, it will be necessary for Taiwanese manufacturers to improve their technology, actively increase value-added services, and promote new southbound policies towards markets such as India, Vietnam, and the Philippines.

With China actively developing an autonomous machine tool strategy, Taiwan's low-end machine tool market will continue to be compressed. Taiwanese manufacturers will need to improve the technical capabilities of machine tools, actively develop high-end and special models to increase added value, and develop the Internet of Things and smart manufacturing to meet the demands of the future. By developing high-performance five-axis processing machines for factory automation, and customizing smart, composite type machine tools to reach diverse niche markets, manufacturers can enhance the competitiveness of Taiwan's machine tool industry.

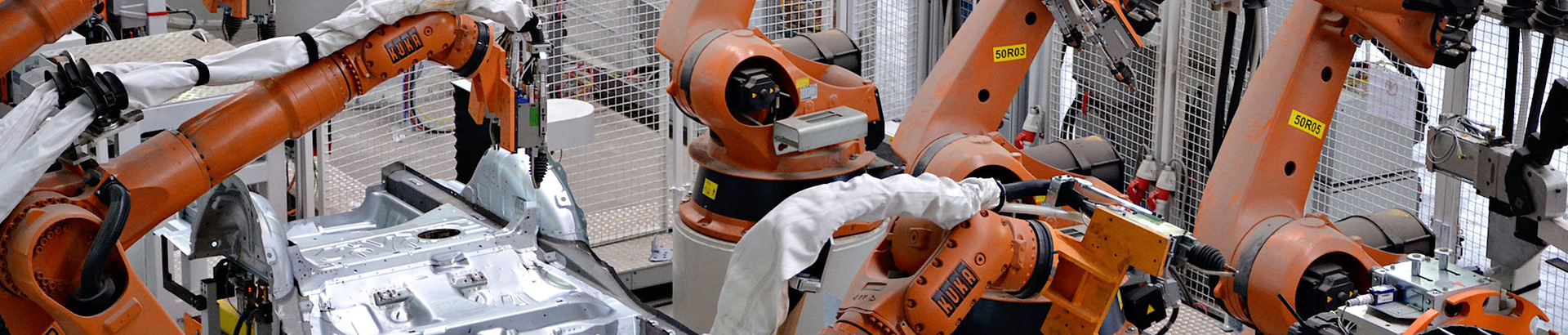

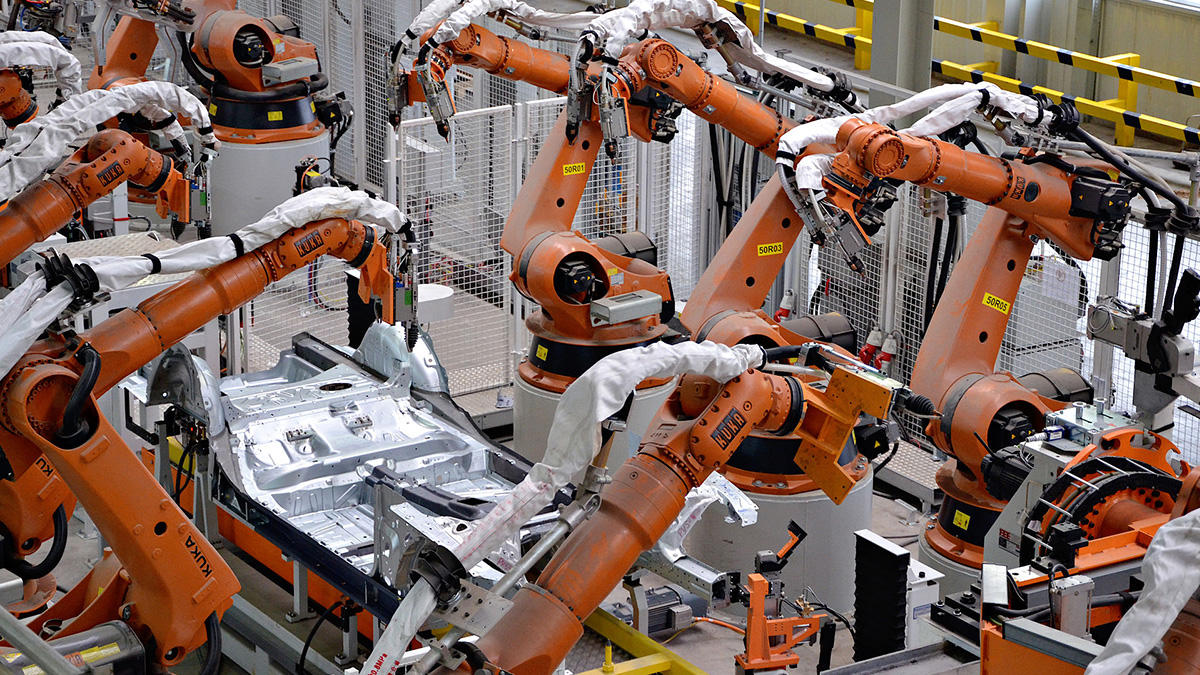

There are huge business opportunities in the robot market, both for industrial robots and service robots. With the aging of the global population, labor costs are expected to increase. Robot applications can be expanded to various fields to reduce labor costs. The need for robots will be long-term and will increase in the future. With the increase in smart manufacturing, especially after the pandemic, robots and automation will be at the core of corporate decision-making in the future.

Taiwan has a complete supply chain system for the electrical machinery industry. In the face of international competition, manufacturers must move towards high efficiency, high precision, high customization, and integration of the entire line of equipment.

Taiwan manufacturers will need to strengthen software capabilities to integrate terminal industry applications, key components, and sales and service capabilities to establish a leading position in the market.

As AI smart devices enter everyone's life, the combination of IoT and AI can maximize efficiency, optimize benefits, and develop artificial intelligence networking (AIOT). A mainstream trend of future technology will be for enterprises to reduce costs, improve efficiency, explore new business opportunities, and then develop new business models. AI, IoT, and AIOT can be applied in industries such as smart healthcare, smart cities, smart retail, and smart manufacturing.

.jpg)

.jpg)