The cloud server market is a cloud infrastructure service that allows service providers and end-users to use virtual networks to build architectures.

Forecast and Analysis of the Global Cloud Server Market

In 2018, the global private cloud server market was worth 30.24 billion U.S. dollars, and the compound annual growth rate (CAGR) from 2019 to 2025 is expected to be 29.6%. The adoption of the Bring Your Device (BYOD) trend and the increasing deployment of mobile workforces have become key factors that are expected to drive the growth of the private cloud server solutions market during the forecast period. The increasing emphasis on ensuring real-time and fast access to data is also expected to drive market growth. The private cloud server envisages providing an infrastructure that is completely dedicated to hosting services for a single organization. It provides all the benefits such as agility, scalability, and the ability to create multiple virtual machines for complex computing tasks and operations, associated with the public cloud while maintaining a high level of data security and privacy protection. Therefore, the single-tenant environment provided by private cloud servers allows companies to take advantage of all the advantages associated with public cloud servers and more secure and customizable hosting resources such as storage, computing power, and networks.

When using cloud servers, organizations rent virtual servers instead of renting or buying local physical servers. You usually pay for what you use based on the capacity required at a specific time. If an organization uses cloud servers, its resources can be expanded or reduced according to the organization's needs, which makes the organization more flexible and cost-effective. When more demands are made on the server, the capacity can be automatically increased to meet the demand without setting up any infrastructure. Cloud servers provide cloud service providers and end-users with flexibility, scalability, cost-effectiveness, and reliability.

Increasing business requirements for maximum flexibility of resources and rapid changes in computing requirements will make cloud-based servers the dominant model in the future. Organizations can use the cloud server market as a production server for web servers, mail servers, application servers, proxy servers, and database servers; or as a development and testing server for application development and project management teams before entering the production phase; or as a response center, to restore business data in the event of a major system failure.

Cloud server solutions help companies reduce costs, increase flexibility, and increase revenue. The factors driving the development of the cloud server market are lower cost, mobility, and no deployment. Cloud servers have been introduced into various industries, including financial services, healthcare, and life sciences, telecommunications and IT, retail, government, manufacturing, tourism and hotels, education, transportation, and logistics. The market integration of cloud servers has become increasingly popular. Welcome and used by companies of all sizes around the world.

- Based on the application: The cloud server market is classified according to applications such as production, development and testing, and disaster recovery.

- Based on the deployment model: The cloud server market includes public cloud, private cloud, and hybrid cloud according to the server category.

- On a vertical basis: The cloud server market covers banking and financial services, government, healthcare, and life sciences, telecommunications and IT, retail, manufacturing, tourism and hotel, education, transportation, and logistics according to vertical fields.

The Growth Driver of the Server Market

Affected by factors such as the impact of the trade war, the conservativeness of corporate investment, and the relatively high base period of data center construction in 2018, the growth rate of server shipments in 2019 has slowed down compared with last year. Li's data center growth rate also converged from double digits to approximately 5%.

As the data center industry's inventory destocking comes to an end, coupled with the expected 5G environment and the gradual maturity of applications, and the increasing demand for the digital transformation of Asian enterprises, according to the estimates of research institutes, the overall server market shipments are expected to grow in 2020 by 4%. Due to the expansion of the data center industry, the growth rate of ODM direct sales business is better than average, and is expected to rebound back from single-digit to double-digit growth. The main driving force comes from the data center industry's focus on developing solutions for the digital transformation needs of Asian enterprises. With the gradual establishment of the 5G environment, the demand for cloud services is driving growth.

Server Market Trends

The original server market business model includes foundries, brands, distributors, enterprise users, and end-users from upstream to downstream. With the rise of cloud services in recent years, and the amount of data is growing substantially, data computing and storage growth will follow. Demand has led to the rise of large data center companies such as Facebook, Microsoft, Amazon, and Google. These cloud giants are building data centers on a large scale to provide relatively low-cost IaaS, that is, infrastructure-as-a-service solutions. This makes general enterprise users tend to outsource data computing and storage services to data center operators. In the global server market, about 40% of the demand for services is provided by data centers, and 60% comes from traditional brand servers. As renting cloud services becomes the trend of enterprise digital transformations, it is expected that the proportion of data centers will continue to increase and the trend will be reversed in the future. Data centers will soon account for 60%, and traditional brand servers will drop to 40%.

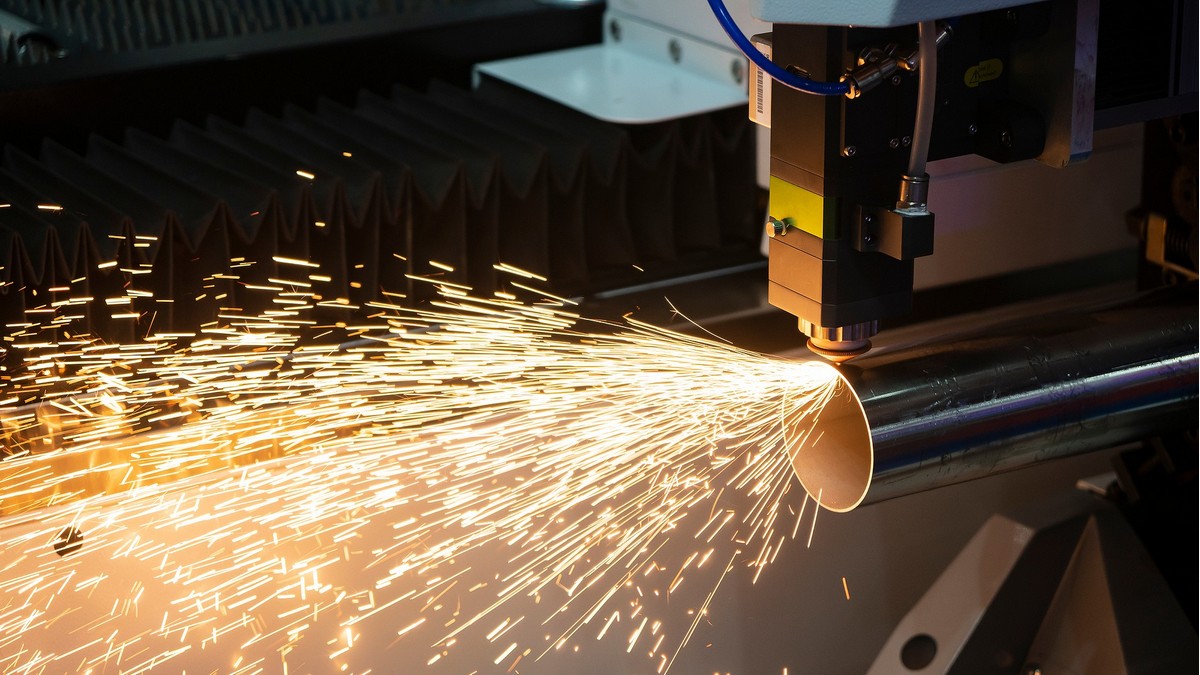

With the development of 5G technology, the server market is also growing. Global 5G commercial operations were launched first in South Korea and then the United States. The extent of 5G equipment is very wide. In addition to telecommunications equipment, it also includes many small base stations and servers. This is the kind of equipment that telecommunications-related equipment companies will need to increase significantly in the next few years. After entering the 5G era, the demand for huge information traffic will require equipment increases. In the 5G era, the demand for network information security is greatly increasing. Taiwanese server manufacturers have excellent server foundry capabilities and have obtained orders from many international server manufacturers.

5G network information security requirements are high:5G has a wide range of applications, including artificial intelligence (AI), self-driving cars, the Internet of Things, medical networks, and national defense communications. In the past 3G and 4G era, if network communications are disconnected, the Internet and network communications will be greatly affected. However, in the 5G era, if the network is disconnected or is attacked by hackers, it will not only endanger network connections, but a break in communication will even affect the safety of self-driving cars, medical networks, and national defense communications.

The area with greatest demand for network equipment is the largest supplier of servers. The North American server market is the world's largest market and accounts for more than 30% of the world demand. The Chinese market is the second-largest market and accounts for about 26%, and the European market accounts for only 23%. China's server shipments grew sharply last year, with China becoming the world's third largest supplier. The China government strongly supports Chinese products for 5G for network information security, and to reduce reliance on foreign suppliers to build servers. The independent supply chain of China has also been supported by the Chinese government and has grown rapidly in a short period.

Cloud data pushes up server demand:More and more countries have officially introduced 5G technology for commercial operations, and China will start the commercial transfer at the earliest in the first half of next year. With the rise of cloud computing and virtualization, through the implementation of virtualization software, the storage space scattered in the server can be managed uniformly to form a virtual storage pool. The public clouds launched by companies such as Amazon, Google, and Microsoft are all visualized architectures and can also sell virtual storage functions to corporate customers. This is the cloud computing technology service that has received attention and application in recent years.

.jpg)