A civil aircraft flying in the sky has Taiwan-made parts in the 90s; many international airlines have aircraft that have been modified and repaired by Taiwan. Taiwan aerospace industry is booming. With the next 20 years, there will be a global aerospace business opportunity of US$6 trillion.

The development and scope of Taiwan aerospace industry

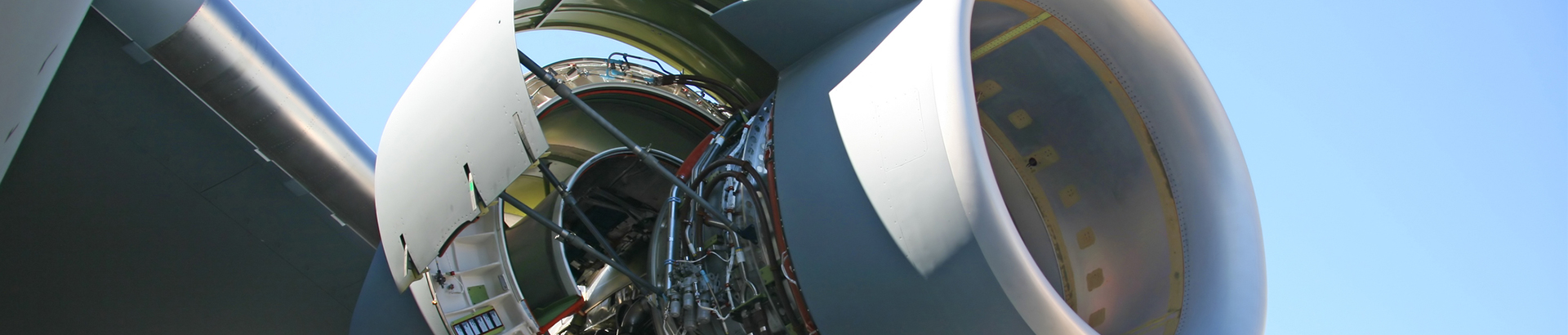

Due to the vigorous development of the aviation industry worldwide, Taiwan’s aviation-related industries have also ushered in broader market opportunities. According to the China Times, Taiwan’s aviation industry has successfully cut into the airframe structure, engine, and interior in the global supply chain. It has established long-term and stable international partnerships with world-renowned companies such as Boeing, Airbus, Bombardier, GE, Pratt & Whitney, Safran, and Spirit Aviation. According to the classification of the aviation industry by the Aerospace Industry Development Promotion Group of the Ministry of Economic Affairs, the development categories of manufacturers can be divided into airframe structure, engine, aircraft interior, avionics, and aviation maintenance. If you look at the distribution of Taiwan’s aviation industry by region, Due to the geographic relationship of Taoyuan International Airport, aviation maintenance manufacturers are mainly concentrated in the north; complete aircraft and mechanical structure related manufacturers are mainly concentrated in the central part, and aero-engine manufacturers are mainly concentrated in the south. In general, Taiwan’s aviation industry has a stable supply chain with high-end technology and talents. There are about 150 manufacturers and 14,000 aerospace industry-related employees in Taiwan. The rapid development of the global aerospace industry and the promotion and guidance of relevant units such as the Ministry of Economic Affairs Taiwan’s aviation industry has established a sound aviation industry supply chain system.

Trends in Taiwan's aerospace industry

The output value has grown steadily, and Taiwan's aviation industry has delivered a brilliant report card

Observing the changes in the output value of Taiwan's aviation industry in the past 10 years, the overall trend has shown steady growth, and the output value reached a record high of NT$134 billion in 2019. The aviation industry is a high-tech industry with complex quality management and system integration technologies. Compared with other competitive industries in Taiwan, such as biotechnology, information, and communications, cultural creativity, tourism, and exhibitions, the aviation industry has relatively low linkages with the global economy. After manufacturers enter the industry, manufacturers can obtain long-term stable production orders. This reflects the steady growth of Taiwan’s aviation industry in terms of output value in recent years. In addition to the evaluation and analysis of global aerospace business opportunities, it is estimated that by 2025, the global aerospace industry and commercial passenger aircraft output value will reach 200 billion US dollars (currently 195 million), and the global aviation maintenance market is predicted to grow to 116 billion US dollars in 2029. (The average annual compound growth rate is expected to reach 3.5%). With global demand growth, Taiwan’s industrial output value is expected to continue to grow and reach new highs.

Cut into the European and American aviation supply chain, the aviation maintenance market has a promising future

Global air transportation continues to grow. In order to ensure flight safety and airworthiness, aircraft maintenance and repairs are in demand in the market. Taiwan, which is located in the Asia-Pacific hub, is actively expanding its aerospace maintenance business. Quality and technology are favored by international manufacturers, and the output value of aircraft engine and airframe maintenance has been growing in double digits year after year. In the field of aviation maintenance, Taiwan has the energy for body maintenance of various airplanes and helicopters and the refurbishment of various engine accessories. After becoming the world's exclusive Boeing 747-400LCF passenger aircraft conversion freighter manufacturer, it has also obtained Boeing 767-300 conversion orders. The maintenance industry can be said to be the hidden champion of the entire aviation-related industry, accounting for 60% of the overall aviation industry output value.

As far as the domestic situation is concerned, although Taiwan has a stable and sound industrial chain, companies such as Hanxiang will still face higher costs. The government can continue to track industry trends and promote policy development. For example, the "National Machinery Manufacturing" and the "5+2 Industrial Innovation Plan" are all helpful to the industry. Relevant departments should consider the resources and advantages of Taiwan's aerospace industry, start at different levels, accelerate industrial evolution and upgrade, and work with the industry to promote industrial development.

Taiwan's aviation industry has established a supply chain system for related civil aviation products and has established partnerships with world-renowned aviation companies such as Boeing, Airbus, Bombardier, GE, Pratt & Whitney, and Snecma. The total output value of Taiwan's aviation industry in 2019 has reached nearly NT$134 billion, an increase of about 11% over the previous year. In terms of aviation investment, more than NT$5.9 billion has been invested in 2019. Projects include R&D and manufacturing of aircraft and engine systems/modules, component manufacturing, aircraft and engine maintenance, etc.

Aviation industry development category

- Body structure: military aircraft body structure, single-aisle aircraft fuselage section, business aircraft tail section, helicopter cockpit section, aircraft door, flight control surface, engine pylon, aircraft landing gear components, and other various metal and composite structural systems/ Components.

- Engine: compression section, combustion chamber, casing, blade, diffuser, ring, fastener, pipe, etc.

- Aircraft interior: aircraft cabin seats, seat structures, cabin fabrics, aviation containers/pallets/cargo nets, oxygen masks, etc.

- Avionics: cockpit display panels, power converters, cabin infotainment systems, microelectronic circuits, connectors, touch panels, cabin wireless smart control systems, aircraft antennas, etc.

- Aviation maintenance: wide-body/narrow-body aircraft, military aircraft, helicopters and other airframes, engines, accessories, aviation instrumentation and electrical maintenance, and passenger aircraft conversion to cargo aircraft, etc.

The global aerospace industry is highly competitive. Taiwan needs to introduce smart manufacturing to enhance its advantages

"In the past five years, the success rate of international orders was only 6%. Quality, delivery, and cost are not as easy as imagined." Ninety-nine percent of aerospace materials are imported, accounting for 55 to 60% of costs. Personnel costs account for 28%, only 10% to 15% of controllable cost space is left. However, Taiwan’s material and labor costs are about US$40 to US$50 an hour. Although lower than Japan, the same figure is only US$8 to US$10 in Turkey, with only one to two dollars in Mexico, the cost is the biggest threat and disadvantage of Taiwan’s aerospace manufacturing industry. The response method is to introduce smart manufacturing to increase efficiency and reduce costs. On the other hand, products, technologies, and supply chain classes must continue to challenge higher levels, and increase value through alliances and cooperation.

.jpg)

.jpg)

.jpg)